The 2025 Charity Finance Investment forum will be returning on 2-3 June.

The pre-forum reception and dinner provides the perfect setting in which to network with peers from other charities. This is complemented by a full day's programme of expert sessions giving insight analysis into a range of investment strategies and crucial investment topics.

Designed for finance directors, chairs, trustees and chief executives responsible for investment portfolios, the forum helps charities shape their strategies and maximise returns. The Charity Investment Forum is an invitation only event for charities with investment assets in excess of £5m.

If you are interested in attending, please contact our events team via email at [email protected]

Programme

02 June 2025

-

3.00PM - 5.00PMArrive and check inHotel reception

-

5.15PM - 6.20PMNetworking drinks reception

-

6.20PM - 6.25PMWelcome address: Matthew Nolan, chief executive, Civil Society Media

-

6.25PM - 7.00PMOpening keynote – Atlantic ties, European Bonds: The UK’s role in a fractured world

With the war in Ukraine reshaping European security and the return of Donald Trump to the White House challenging transatlantic relations, where does the UK position itself in this evolving geopolitical landscape? In this talk, Professor Anand Menon, a leading expert on UK-European relations, will explore how the conflict in Ukraine, shifting EU dynamics, and US foreign policy under Trump are influencing Britain’s role on the world stage.

David Rennie, geopolitics editor, The Economist

-

7.00PM - 9.00PMDinner

-

9.00PM - 12.00AMInformal networking

03 June 2025

-

7.00AM - 8.30AMBreakfast

-

8.30AM - 9.10AMWorkshops

-

9.10AM - 9.20AMTransit time

-

9.20AM - 10.00AMWorkshops

-

10.00AM - 10.40AMRefreshment break and networking

-

10.40AM - 11.20AMWorkshops

-

11.20AM - 11.30AMTransit time

-

11.30AM - 12.10PMWorkshops

-

12.10PM - 12.20PMTransit time

-

12.20PM - 1.00PMWorkshops

-

1.00PM - 1.15PMTransit time

-

1.15PM - 3.30PMLunch, networking and closing keynote

Workshops

|

W1: CCLA Hot wars, trade Wars, tariffs and tax – how can we navigate Trump? Elon Musk/DOGE and Scott Bessent want smaller deficits while Germany does a screeching fiscal U-turn to raise its deficit. So we have fiscal tightening in the US, fiscal loosening in Europe. Can US equity outperformance of the rest of the world possibly continue its 17-year run? Also, is Trump inflationary? Ben Funnell, head of investment solutions |

||||||||||||||||||||||||

|

W2: Cazenove Capital Trump, tariffs & turmoil: navigating geopolitical risks Trump’s re-election prompted much debate over whether his more disruptive campaign pledges would come to fruition. Whether tariffs, deportations or the war against woke, it seems the administration are prepared for some economic discomfort to get their priorities done. This session will explore the impact of Trump’s trade policies, focusing on tariffs as an economic tool and their broader geopolitical consequences. We will assess how protectionist policies are shaping global markets, supply chains, and diplomatic relations as well as examining the risks and opportunities these policies might pose for your charity investment portfolio. Tom Montagu-Pollock, co-head of charities Grace Lavelle, investment strategy director |

||||||||||||||||||||||||

|

W3: Rathbones Navigating the backlash against ESG investing For decades, trustees have had the ability to align their investments with their charitable objectives and values. Over time, this approach gained momentum, influencing a growing number of investors and shaping market dynamics. However, in recent years, a backlash has emerged against ESG and values-based investing, raising new challenges for those committed to sustainable and responsible investment strategies. In this session, we will examine the roots of this backlash, its implications for ESG investors, and how the investment community can respond. Join us for an insightful discussion on the future of values-driven investing in an evolving landscape. Laura Hobbs, investment director, Greenbank Investments |

||||||||||||||||||||||||

|

W4: Quilter War, what is it good for? For a long time, aerospace and defence companies have been persona non grata as an investment within the charities sector. However, in recent years, with the war in Ukraine and the shifting geopolitical landscape, trustees are challenging the status quo. In this session, we will explore the investment case for defence companies, whether their inclusion in charity portfolios can be justified and can they be viewed as a ‘responsible’ investment. Speaker tbc |

||||||||||||||||||||||||

|

W5: Evelyn Partners Accurate at time of printing: the impact of geopolitics on financial markets Geopolitics have been dominating the investment landscape recently as both macroeconomics and company fundamentals take a back seat. What does this mean for charity investors and how can we structure long-term portfolios to minimise the risks and maximise the returns in the face of the inherently unpredictable? David Goebel, investment strategist |

||||||||||||||||||||||||

|

W6: Newton Investment Management

|

What to expect at the Forum...

- Welcome drinks reception

- Formal three course dinner

- After-dinner networking reception

- A choice of 16 expert sessions

- Opportunity to network with leading sector professionals

- A complimentary room and access to venue facilities

Your invitation to the Charity Investment Forum

We are delighted to announce the return of our annual Charity Investment Forum and Dinner on the 2nd-3rd June, hosted by Charity Finance.

For Summer 2025 we will be moving to the beautiful Oatland Park Hotel in Weybridge. The pre-forum reception and dinner provides the perfect setting in which to network with

colleagues from other charities. This is complemented by a full day’s programme of 16 expert sessions giving insight and analysis into a range of investment strategies and crucial investment topics.

As with previous years, we have incorporated your feedback into designing a thought-provoking and educational learning programme. You will be able to select the most

appropriate sessions for your personal needs and objectives, providing a rare and highly time-efficient opportunity to compare and contrast different investment approaches and styles in a peer-supported and non-pressured environment.

Thanks to the support of sponsors, your place will be complimentary. It includes the pre-forum drinks reception and dinner on 2nd June, accommodation for that night, and entry to the seminar sessions on 3rd June.

Please RSVP via email at [email protected] to secure your place. You can find out more information at www.civilsociety.co.uk/SummerCIF.

Tristan Blythe

Editor, Charity Finance

New venue: Oatland Park Hotel

We are delighted to announce for Summer 2025 we will be moving to Oatland Park Hotel in Weybridge.

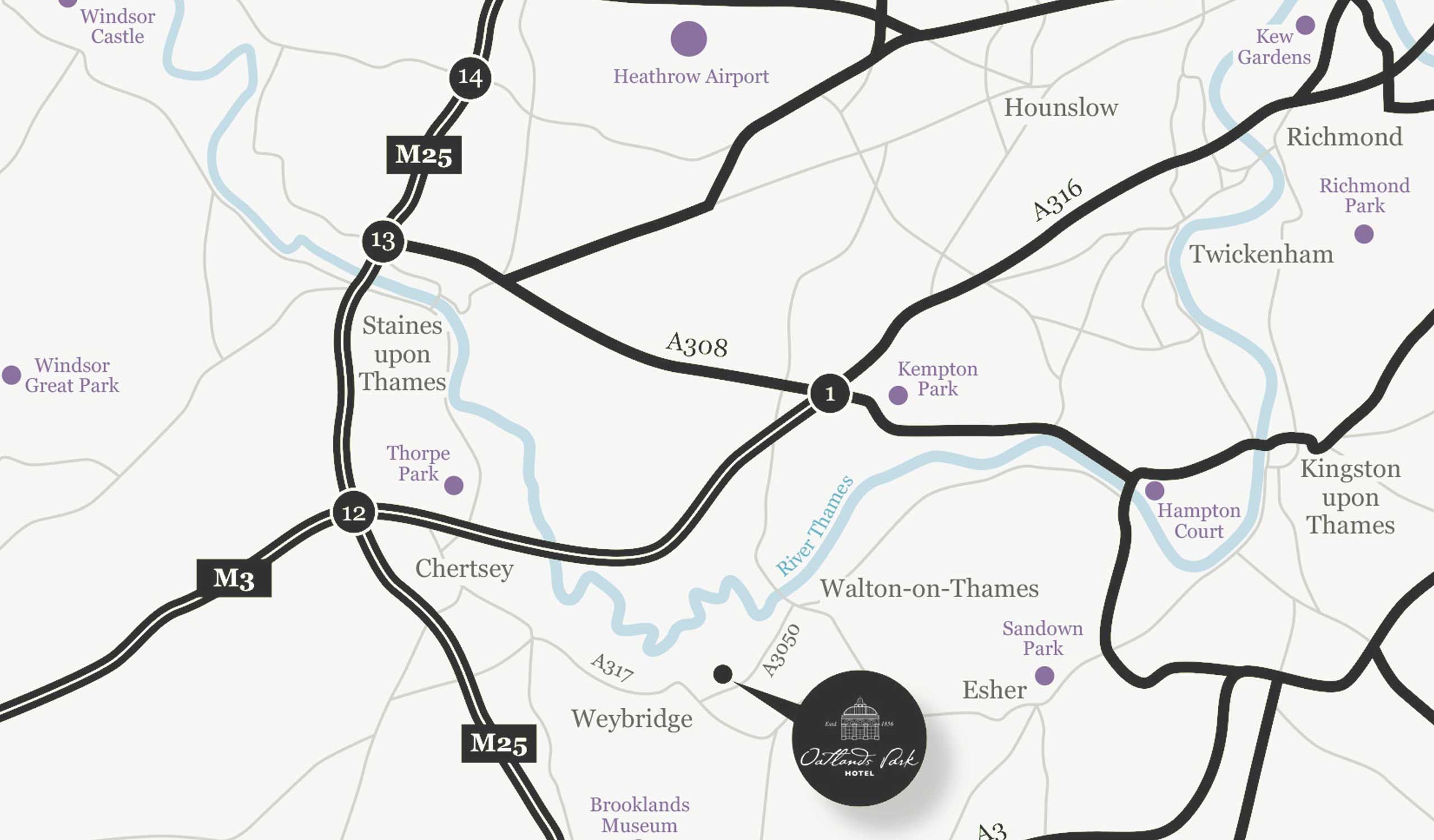

Set within 10 acres of picturesque Surrey parkland and only a 20-minute drive from London Heathrow airport, Oatlands Park Hotel offers a countryside escape with fast transport connections to central London.

Oatlands Drive

Weybridge

Surrey

KT13 9HB

Oatlands Park Hotel is on Oatlands Drive, directly opposite Oatlands Park Recreation Grounds and between Weybridge High Street and Oatlands Village.

Getting there:

By train: The nearest railway stations are Weybridge (1 mile) and Walton-on-Thames (1.8 miles). South West Trains take 30 minutes to Weybridge and 26 minutes to Walton-on-Thames from London Waterloo. Taxis are available from the station.

By Car: Oatlands Park Hotel is 2 miles from the M25 (Junction 11). Continue to Weybridge High Street and follow signs to Walton-on-Thames. At Monument Hill roundabout, take the second exit onto Oatlands Drive (A3050). Drive 40 yards and turn left onto Churchill Drive and then follow the road to Aspen Square. We are also minutes from the A3 and M3 motorway.

The hotel has a secure, private car park with plenty of parking.

There are 4 points for charging electric vehicles located at the parking bays at the front of the hotel. To pay for electric parking, simply download the EVC Plus app from the App store. Plug your electric vehicle into the charge point, scan the QR code on the side of the charger, and select ‘start charging’ on the app. Wait for the icon on the charger to turn blue and your electric vehicle will now begin charging.