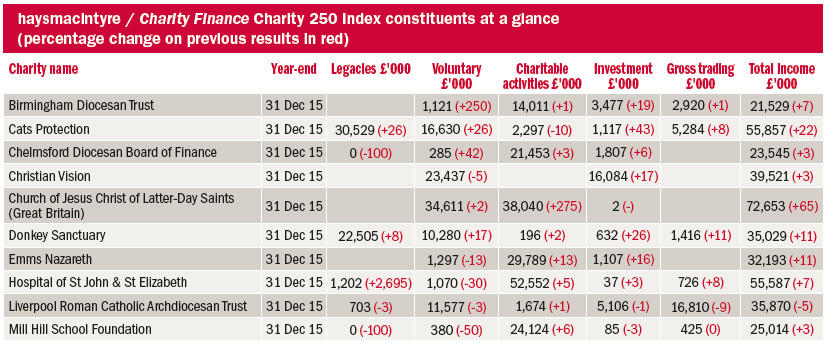

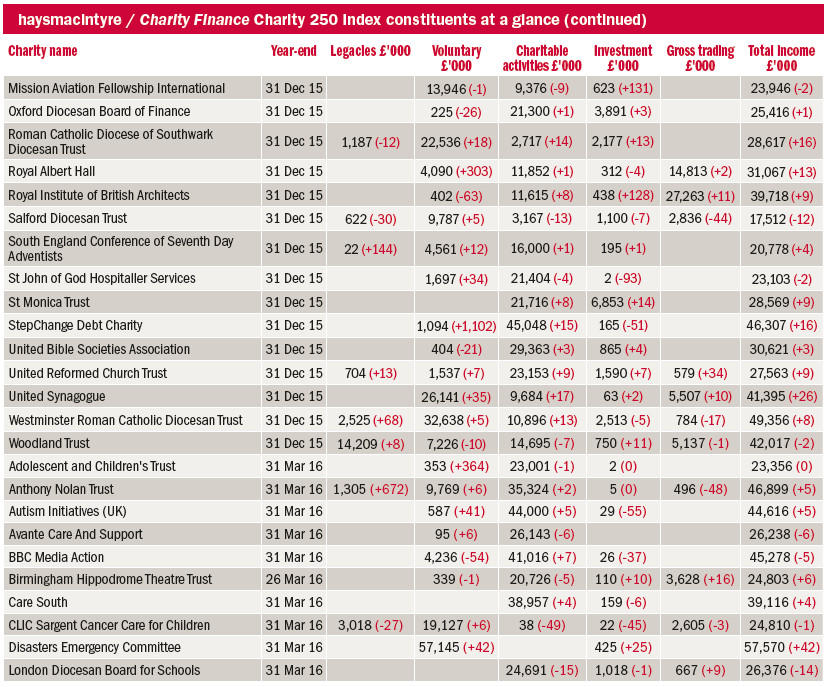

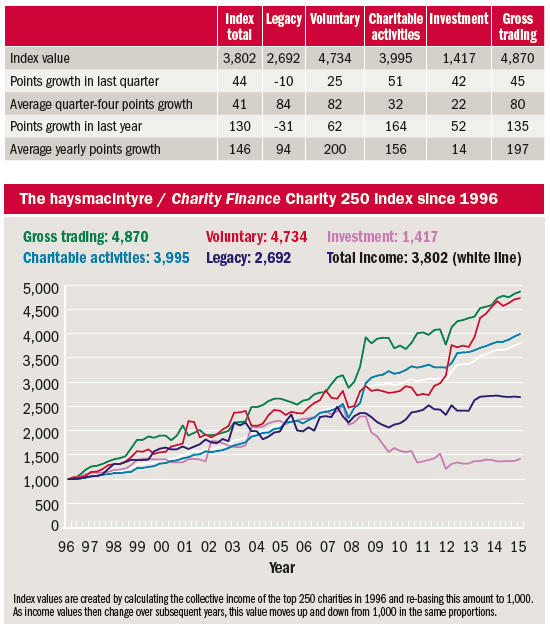

The haysmacintyre / Charity Finance Charity 250 Index has performed above expectation for the third successive quarter in the three months to 31 December 2015. It has risen 44 points – three points ahead of its average quarterly rise.

Investment income and income from charitable activities were the top-performing income streams, beating their quarterly benchmarks by 20 and 19 points respectively. This was sufficient to offset subpar performance from legacies, voluntary and trading income, which fell short of their quarterly benchmarks by 94, 57 and 35 points respectively.

The good news has been fairly evenly shared this quarter, with 44 of the 59 charities reporting income rises. Six charities have done particularly well, posting income rises of 20 per cent or more, namely Church of Jesus Christ of Latter-Day Saints (Great Britain); the Challenge Network; United Synagogue; Sightsavers International; Cats Protection and the North of England Zoological Society.

The top-performing charity, by quite some margin, in the quarter under review is the Church of Jesus Christ of Latter-Day Saints (Great Britain), which reported a 65 per cent increase in total income to £72.7m, off the back of a 275 per cent increase in income from charitable activities. This was due primarily to an increase in grant income from the Mormon charity’s Utah-based parent company, the Corporation of the Presiding Bishop of the Church of Jesus Christ of Latter-Day Saints, which more than tripled its contribution from £8.3m in 2014 to £36.8m in 2015. The UK charity acts as the agent of the parent company in the transfer of funds to and from other Church entities globally.

The Challenge Network also performed extremely well, posting a 43 per cent increase in total income to £51.7m. This is due to a comparable rise in contract income following an increase in the number of young people undertaking National Citizen Service (NCS).

In October 2014, the Challenge Network learnt that it had won contracts to deliver NCS in seven regions of England until 2018. The total value of these contracts is approximately £250m.

Religious charities

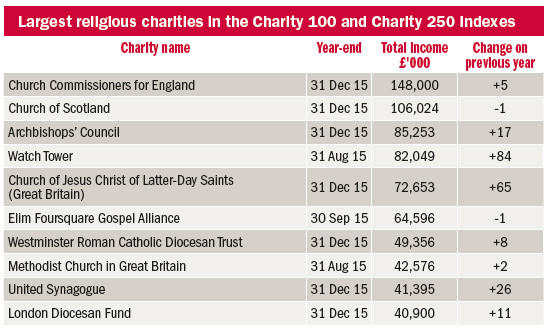

Around a quarter of charities filing their accounts in the fourth quarter are religious organisations. Across the Charity 100 and Charity 250 Indexes, there are over 25 religious charities, ranging from the Church Commissioners for England with annual income of £148m to the Salford Diocesan Trust with £17.5m.

In terms of sector, they span many of the different denominations of Christianity, such as the Church of England, Roman Catholicism and Mormonism. Judaism is also represented, via United Synagogue.

Many charities have religious roots or a strong religious ethos underpinning the services that they provide. This is particularly the case in the hospital, care home and schools sectors, where a charity may have originally been set up by a religious order. However, for the purposes of the Charity 100 and 250 Indexes, religious charities are defined as those that exist purely to promote religious faith and worship. Thus charities such as Islamic Relief Worldwide, Jewish Care and MHA (formerly known as Methodist Homes for the Aged) are classified according to the services they provide despite having a strong religious ethos.

Christianity is clearly the most well-represented faith among religious charities in the Indexes, and of the 42 Church of England dioceses and 22 Roman Catholic dioceses or bishoprics in the UK, 11 meet the £20.6m three-year average income required for membership.

The primary source of income for most diocesan boards of finance is the contribution from the parishes in their jurisdiction – known as the “parish share” – which in turn is raised from collections, committed giving and gift aid from their local congregations. The dioceses are responsible for paying for the clergy and other diocesan ministries that support the parishes, such as youth work, children’s work, stewardship and communications, and deploying these resources effectively across the parishes to maximise community engagement.

The diocesan boards of finance may also raise revenue from property or land that they own – both in terms of rental income or outright sales. In practice, however, there are often restrictions over the uses to which the proceeds from such sales can be put.

The biggest threat to the dioceses’ main source of income is, of course, diminishing congregations, which can result from secular trends in society and questions over the church’s relevance, reputational issues facing the church and competing faiths. Research undertaken by the Roman Catholic Church has shown that while congregation sizes are fairly static, the amount given per parishioner has actually been rising. The sustainability of this situation is, however, open to question.

“One of the biggest challenges facing the income raised from church congregations is generational change, as young parishioners have higher housing and living costs than older parishioners and less money to give, both in terms of donations and legacies,” says haysmacintyre’s head of faith charities Adam Halsey.

For dioceses that need to supplement donations from parish congregations, there are other opportunities to generate income. “Many dioceses are asset-rich and cash-poor, and could derive greater value from their land and property portfolios, both in terms of selling and developing the assets that they own,” says Halsey.

“Similarly, the opportunity for trading income, which has been tapped by many cathedrals that operate both as tourist attractions and places of worship, is also underexploited.”