We live in extraordinary times. Back in 2007, who would have thought that interest rates would not only be cut to almost zero but also stay more or less on the floor for the next 10 years.

Of course, financial assets of all types have flourished in an environment where money (debt) is almost free. Investors in search of some income from their hard-earned savings have pushed equity and bond prices up to all-time record levels, including UK government index-linked bonds. These are government bonds where the interest rate paid to investors (and the capital returned at the end) is linked to the rate of inflation. This has seen the price of the longest-dated such bonds almost triple since the financial crisis in 2008.

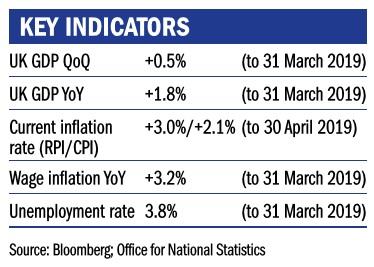

Index-linked bond prices are driven by two factors: expectations of future interest rates and future inflation. If interest rates fall or inflation rises, the price goes up. Hence, immediately after the Brexit vote, as sterling weakness pushed up inflation and UK interest rates were cut, the price of these bonds rose rapidly from £200 to £270.

Populist governments

So owners of these index-linked bonds win if interest rates fall, as has been the case for the last decade. But, importantly, they also win if inflation rises, as we fear may be the case in the coming decade as increasingly populist governments threaten to fire their fiscal bazookas.

What price sterling and UK inflation if Jeremy Corbyn comes to power? Even if that does not come to pass, we believe the rising risk of fiscal (rather than monetary) stimulus poses significant upside risks for inflation.

Of course, there is no such thing as an asset with no downside. You may be a winner on either heads (inflation) or tails (low interest rates) with index-linked bonds, but the coin could land on its side. This would be the equivalent of growth and interest rates returning to pre-crisis levels – unlikely in our view given the excessive debt levels, but not impossible. In such a case, these index-linked bonds would fall very significantly.

The political winds seem to be shifting towards a more inflationary outcome, but index-linked bonds – especially the long-duration bonds shown here – can also be volatile. So it is worth maintaining a balance between long-dated index-linked bonds and more conventional assets such as equities and gold.

Can you have your cake and eat it then? Of course not, but for investors’ portfolios, UK index-linked bonds may turn out to be the next best thing.

Steve Russell is an investment director at Ruffer

Ruffer LLP is a limited liability partnership, registered in England with registered number OC305288 authorised and regulated by the Financial Conduct Authority. The information contained in this article does not constitute investment advice or research and should not be used as the basis of any investment decision.

Related articles