The global equity market, having reached all-time highs towards the end of January 2018, dropped almost 10 per cent by 7 February. However, looking at the US market a month on, you might conclude that the fall was no more than a blip. The US equity index, the S&P 500, is back above where it ended 2017, and although other developed equity markets remain below the highs of 2017, investors’ concerns regarding immediate inflationary risks and increased volatility have seemingly abated.

The focus in the US appears to once again be on President Trump’s next move. His brash calls on tariffs this month have increased concerns about trade protectionism, with the departure of the market-friendly voice of Gary Cohn adding to the disquiet. However, within days of announcing his tariff plan, Trump had moderated the proposal somewhat and that, along with the help of a tax reform tailwind and expectations of increased corporate activity, has helped support the market’s recovery.

Populist threat

The rise of political risk and the threat of populism remains at the forefront of investors’ minds in Europe and the UK. The result of the Italian election, with the Five Star Movement’s win, is yet another example of the political establishment being thwarted in favour of change.

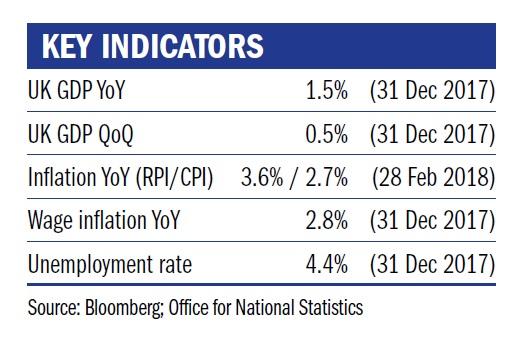

Where does this leave investors? It is fair to say that there is a somewhat heightened awareness of the potential for inflation to surprise on the upside after the jolt in markets at the end of January. This presents a strange dichotomy where good news in the economy might mean bad news for stock markets. As economies recover, central bankers will be able and willing to raise interest rates, removing a key support mechanism for asset prices.

The threat of higher nominal interest rates in the short term is a real one, but begs the question – will the current level of asset prices survive further upward pressure on policy rates? We would suggest not, or at least not without a bumpy ride. If central banks make a “policy mistake” and a dislocation in equity markets translates into recessionary pressure in the real economy, do central banks have any ammunition left to step in and hold up the economy as they have done time and time again? We think that this current phase of central bank intervention concludes with governments being called to action with (more) fiscal stimulus measures.

Jenny Renton is investment manager at Ruffer.

Charity Finance wishes to thank Ruffer for its support with this article