February has been an eventful month for financial markets. US economic data surprised on the upside, and with wages now growing at their fastest pace since the financial crisis (2.9 per cent), many investors were left to reassess their assumptions on interest rates. Increased fears of rising inflation and the likelihood that the US Federal Reserve would pursue a more aggressive path of interest rate increases unsettled both bond and equity markets. This uncertainty was compounded by some of the structures and strategies within the financial system that make bets on volatility in asset prices, and which have evolved since the financial crisis.

The new chair of the Federal Reserve, Jerome Powell, took office on 5 February. This was certainly an interesting time for a change of leadership at the US central bank and has only added to the speculation as to what the future holds for interest rate policy. In the short term, many commentators now expect the US federal funds rate to reach at least 2 per cent by the end of 2018.

UK uncertainty

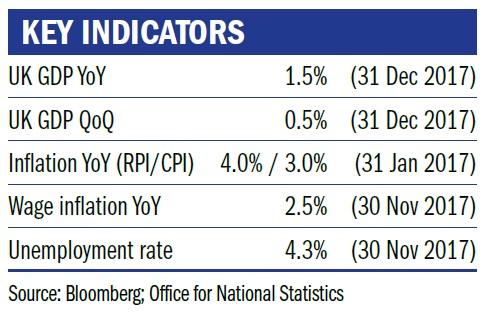

In the UK, the picture looks just as uncertain. The Bank of England met at the beginning of February, after which Mark Carney made it clear that despite the unknowns surrounding Brexit, the UK economy was doing well and was in fact at risk of “overheating”. In other words, increasing inflationary pressures are a cause for concern, and the Monetary Policy Committee felt that it will be required to start raising interest rates more rapidly than previously expected. This, on top of the interest rate dynamic in the US, increased interest rate expectations in the UK.

The recent increase in volatility witnessed in financial markets may well be short lived, although we fear that these jitters have cause to continue and indeed worsen in severity. At Ruffer we have been concerned for some time about loose monetary policy’s role in inflating and supporting asset prices and compressing volatility – and more specifically how assets (equities and bonds) will react when central banks start to withdraw this support. We believe that the turbulence in the first few weeks of February is a reminder of the structural vulnerabilities within the financial markets, and continue to focus on protection to preserve our clients’ capital.

Jenny Renton is investment manager at Ruffer.