A decade ago, a person or indeed charity would have received over five per cent interest on the cash held in their bank account.

Since the central banks’ emergency monetary stimulus response to the financial crisis drove interest rates towards historic lows and initiated a large scale asset purchase programme, bank accounts in the UK have yielded virtually nothing. This has left those requiring an income to look to higher risk assets to sustain their income yield.

We have been concerned for some time that charities which traditionally followed a “lower-risk” approach have been forced to move further up the risk spectrum. We believe that this “search for yield” strategy looks increasingly risky as quantitative easing (QE) turns to quantitative tightening (QT) and the global interest rate cycle begins to turn.

In as much as QE has dampened market volatility, there is the danger that near-term measures of portfolio risk are throwing off false signals as to the actual risk that is being assumed to generate the level of income required by many charities.

$15tn of asset purchases by central banks have pushed equity prices far ahead of the levels that can be accounted for by the level of growth witnessed in the underlying economy.

To the end of last year, US nominal GDP had expanded by 37 per cent since 2009; the S&P 500 meanwhile, returned around 380 per cent from its 2009 trough. As such, we believe asset prices will be vulnerable to selling pressure when the rate of interest on lower risk assets rises.

Inflation across the Atlantic

The US Federal Reserve has started the process of reversing its asset purchases. In addition, it is clear that investors have moved from a deflation mindset to a more inflationary outlook.

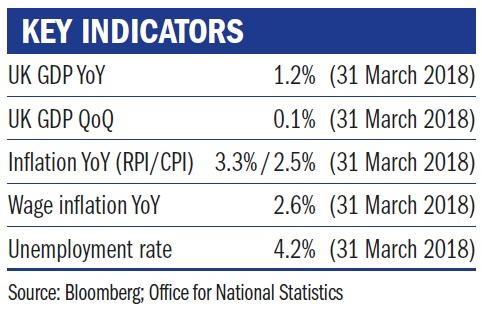

The election of Donald Trump in the US added fuel to the inflationary fire, and although the beginning of 2018 in the UK has seen a lower rate of inflation than had been expected, the message from the Bank of England was essentially one of wait and see. They continue to forecast an inflation rate of 2 per cent within two years.

As inflationary pressures continue to build, the greater the imperative for further upward moves in interest rates from central banks. While we continue to expect such moves to be modest, the turning of this cycle is likely to result in more volatility in financial markets, and with that the inherent risks in higher yield strategies will become more apparent.

Jenny Renton is an investment manager at Ruffer

Sponsored by Ruffer