The shadow that loomed over the UK economic outlook towards the end of 2018 does not look likely to abate anytime soon. While investors and consumers might have been hoping for some good news during the festive period, Brexit uncertainties only intensified. This political ambiguity continues to weigh on planned business investment, the UK housing market and consumer sentiment.

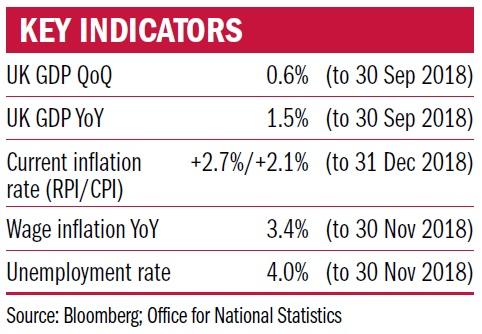

Awkwardly for the Bank of England, these headwinds make interpreting the underlying data of the economy fiendishly difficult, not least because they conflict with building inflationary pressures indicated by low unemployment rates.

Therefore in December, the central bank elected to keep interest rates at 0.75 per cent, as it continues to grapple with how these contradictory forces are shaping monetary policy. Although this is good news for many with floating-rate debt, it signals that Brexit is hampering short-term economic growth.

The debate will no doubt continue to dominate UK policy and it seems apparent that the interest rate outlook for 2019 now relies, almost solely, on the nature of the EU withdrawal. An “orderly” Brexit could provide enough short-term relief in sentiment to allow the Bank of England to raise rates once again, rewarding savers but pinching borrowers.

Anything else, including a chaotic no deal scenario, could mean the turmoil may be too great for the Bank to risk such a move. Uncertainty has become somewhat the norm in the UK and the poor performance of domestic financial markets and sterling has made it clear how investors feel about this.

Global outlook

Meanwhile, the US Federal Reserve continued to raise rates in December, much to the dismay of investors. The shadow that loomed over the UK economic outlook towards the end of 2018 does not look likely to abate anytime soon. While investors and consumers might have been hoping for some good news during the festive period, Brexit uncertainties only intensified. This political ambiguity continues to weigh on planned business investment, the UK housing market and consumer sentiment.

Awkwardly for the Bank of England, these headwinds make interpreting the underlying data of the economy fiendishly difficult, not least because they conflict with building inflationary pressures indicated by low unemployment rates. Therefore monetary policy has a wide-reaching impact on global financial conditions.

As the weakness intensified in the US stock market (which had been the last bastion of strong performance amongst the major equity markets), investors hoped that the Federal Reserve would offer a little relief in the form of a comforting rhetoric or a pause in rate rises. The eventual reassurance was effective but, we expect, temporary in nature.

Ultimately the global tightening cycle is on track to spoil the party. The difficulty for investors will be navigating a world with tightening monetary policy and increased volatility, which can negatively impact both stocks and bonds at the same time.

Oliver Shale is an investment manager at Ruffer

Ruffer LLP is a limited liability partnership, registered in England with registered number OC305288 authorised and regulated by the Financial Conduct Authority. The information contained in this article does not constitute investment advice or research and should not be used as the basis of any investment decision.

Related articles