It is very hard not to mention Brexit in any discussion relating to UK interest rates. The Bank of England’s strategy is informed by an inflation forecast which takes into account current levels of inflation, the cost of goods, consumer spending, investment levels and wage growth.

Every one of these measures is impacted directly by the outcome of Brexit, and indirectly by the prevailing sentiment. This shadow has loomed large over the UK now for three years, and in a statement earlier this year the Monetary Policy Committee said “whatever form Brexit takes…we will act to achieve the 2 per cent inflation target”.

Brexit aside though, given the predilection for central banks to continue to extend monetary (and now fiscal) support, what could possibly force the Bank of England’s hand to raise rates?

Externally, positive macro developments, whether related to China-US trade, increased fiscal spending in Europe or indeed any other significant source, could force the BoE’s hand. However internally, the pithy answer to the question might be “very little”.

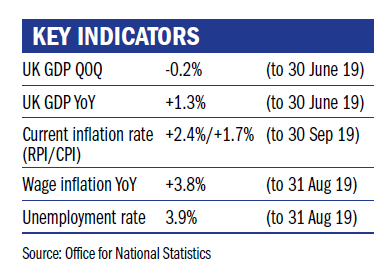

Prevailing levels of inflation are below target, with the ONS’s most recent CPI number at a three-year low of 1.7 per cent, and cost pressures are minimal with a benign outlook. Consumer spending is flat at the moment, and investment levels are limited by Brexit concerns.

The one counter to this that in the UK, the unemployment rate is near historic lows with more people in work at any time since the beginning of the 1970s. Over the past year momentum in wage growth has accelerated, reaching 3.8 per cent in August, and it has now outstripped inflation for more than 18 months.

Therefore, at the moment one could argue that the greatest risk to inflation accelerating is wage growth.

Admittedly, there are some concerns that the jobs market might be cooling as employment has fallen for three months and vacancies have been falling throughout 2019. But if a positive resolution is achieved with Brexit, then we would likely get a continuation of the medium-term upward trend in wage growth.

These higher wage costs may then translate into rising consumer prices, and any sustained move in these would bring pressure to bear on the Bank of England.

This may not seem a likely outcome now as we look down the barrel of further Brexit related concerns, but the pressures in the labour market have been building for some time.

Edward Donati is an investment manager at Ruffer

Ruffer LLP is a limited liability partnership, registered in England with registered number OC305288 authorised and regulated by the Financial Conduct Authority. The information contained in this article does not constitute investment advice or research and should not be used as the basis of any investment decision.

Related articles