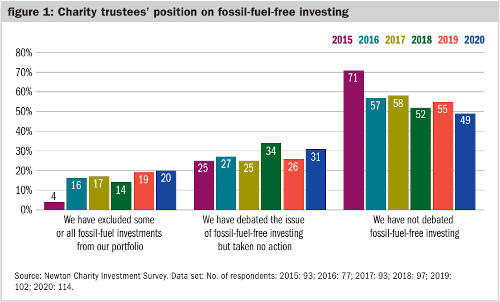

As climate change looms large over society, an increasing number of charities are being scrutinised for investments in fossil fuels. The proportion of charities excluding fossil-fuel investments, or considering doing so, is growing steadily. According to Newton’s annual Charity Investment Survey, conducted among leaders and decision-makers in the UK charity sector, the proportion of charities excluding some or all fossil-fuel investments has risen from just 4% in 2015 to 20% in 2020. In April 2020, the University of Oxford’s endowment fund joined a growing list of institutions that have announced plans to exclude all fossil-fuel investments.

Fossil-fuel companies vulnerable to change

At the same time, the fossil-fuel sector in its current guise now looks increasingly vulnerable to becoming irrelevant to future investors. In 2019, the MSCI World Index was up almost 24% in US-dollar terms, while the MSCI World Energy Index returned just over 12% and has underperformed its wider global equity equivalent in four of the last five years. Despite a recovery in the oil price from record lows as global lockdowns have eased, falling returns on capital, volatile energy prices and the rise of renewables had increasingly made fossil-fuel investments an unappealing choice for investors. Their primary salvation was high dividend yields for those in need of income in an income-starved world.

In 2020, as severe restrictions were imposed on the global economy as a result of the efforts to curb the coronavirus, the International Energy Association (IEA) predicted that demand for oil and gas could fall by over 5%, while growth in output from solar and wind was expected to rise by about 5%. In the UK, 37% of electricity production came from renewables in 2019, and their increased use is a trend which is being replicated across the globe.

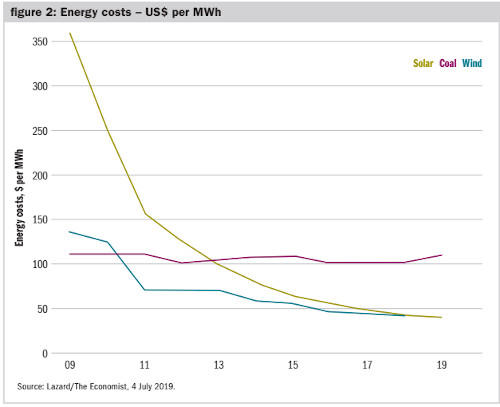

As the cost of renewable energy falls further, grid systems adapt, and material science evolves, the abundance of green energy is likely to progressively undermine the economics of fossil fuels.

While Covid-19 lockdowns are expected to have a negative immediate impact on the commissioning and construction of some renewables projects, investors actually gave the green light to US$35bn worth of offshore wind projects worldwide in the first half of 2020, more than quadrupling the figure from the previous year in this area, and the long-term forecast for other renewables appears bright.

Not only have investors in the oil and gas sector seen unsustainable dividend yields cut, they have also experienced painful losses in high-yield and private-debt holdings linked to fossil-fuel investments. For those investors not persuaded by concerns over climate change and the rapidly increasing competition from renewables, losses from oil and gas holdings in their portfolios are bringing home the reality of investing in assets where the tide of history is against them.

Demand for oil and gas is likely to bounce back, and the oil price may well recover further from present levels too, but does this matter? Prices are set by marginal demand, and if the future rate of change is negative, in our view, even the high yields on offer could provide insufficient compensation for the risk of asset impairment and redundancy.

Changing client preferences

But there is another influence that is diminishing the demand for fossil-fuel investments: client preferences. While investment managers are increasingly being asked to divest from fossil-fuel investments by pension funds, private clients, charities and foundations, this is not the only issue. We are also seeing more and more lobbying of banks and insurance companies to cease funding fossil-fuel businesses. One leading UK bank has already announced that it will no longer fund fossil-fuel investments, and other commercial banks are under pressure to follow suit. And it is not only the production of fossil fuels that is in focus: the use of petrochemical products, such as single-use plastics, is a topic for active engagement by investors who are putting pressure on major food companies to limit their use.

Many major oil companies are pledging that they will be running zero-carbon strategies by 2050, reflecting the demand from many in civil society for a more rapid energy transition, and the pressure for increased disclosure and reporting of their carbon footprints. The hidden message in these announcements is the calling out of governments to put in place the incentives (and disincentives) to accelerate that transition. Betting on continuous support from governments for fossil fuels as a central plank of an investment thesis could be a proposition based on shaky ground.

Against this backdrop, charities may be seeking investment solutions that can enable them to integrate climate-change concerns, the energy transition and other important considerations into their portfolios. Investment strategies with sustainability at their core can encourage a better allocation of capital with the aim of improved long-term global outcomes for society and the environment, alongside generating resilient risk-adjusted returns.

Many active investment strategies with a sustainable remit view engagement as a critical part of the stewardship role. A growing number of charities also see the merits of engaging with companies to seek to change their behaviour, recognising that such an approach does not have to come at the cost of investment returns and can, in fact, improve them. In 2020, 63% of the charities that we surveyed felt that ESG (environmental, social and governance) engagement had an impact on investment performance, with 69% of those charities believing that the impact was positive.

Engaging for the future

Active, engaged investment managers can push for corporate change, working with companies to increase the sustainability of their businesses over time. For example, in 2019, under the Climate Action 100+ initiative, a group of international investors co-filed a special climate-change shareholder resolution, asking BP to explain its thinking on climate change and how its business is aligned with the goal of the Paris Agreement to keep global warming to well below 2°C. This initiative took place after more than six months of engagement. The board positively supported the proposal, and at BP’s AGM the resolution received huge support, gaining 99.14% global investor approval, the highest ever investor support for an ESG resolution. This demonstrates what can happen when investors engage constructively with companies on important issues.

A well-managed sustainable investment strategy can also seek to identify and invest in the winners – companies with exposure to trends such as clean energy provision, or the transition to the electric vehicle – which should be well positioned to benefit from structural demand in such areas. For example, many renewable-energy assets benefit from steady government subsidies that can help to underpin the value of investments in the sector, and offer investors important diversification benefits. Furthermore, while the coronavirus crisis has resulted in many dividend cuts in wider equity markets, renewables have continued to pay stable dividends throughout this turbulent period. This can help to compound returns over the longer term, and is also particularly relevant to charities that require a regular income from their investments.

Climate change is a multi-faceted issue for the investment community, and there are many complexities associated with the energy transition. However, we believe an active investment approach which integrates ESG considerations and prioritises engagement could be a compelling option for charities that wish to achieve their long-term investment goals in a responsible and sustainable manner.

Bhavin Shah is a charity portfolio manager at Newton Investment Management

Charity Finance wishes to thank Newton for its support with this feature