This update coincides with a hung parliament, and thus there are increased uncertainties for UK-based investors. What is clear, however, is that a resurgent Labour Party has touched a nerve across the country, and as summed-up by the former US Democratic Party presidential candidate Bernie Sanders, there has been something of a “rising up against austerity”. It was notable that during the UK election campaign, there was a Keynesian drift in policy even by the incumbent government, and this reflects global rather than uniquely domestic pressures.

Economic growth rates remain unlikely to reach the very robust levels required to even begin to address the overwhelming debt levels prevailing in the global economy. With monetary policy having disappointed as a stimulus, the baton now sits firmly in the hands of central governments, which are under growing pressure to respond with “fiscal” inputs.

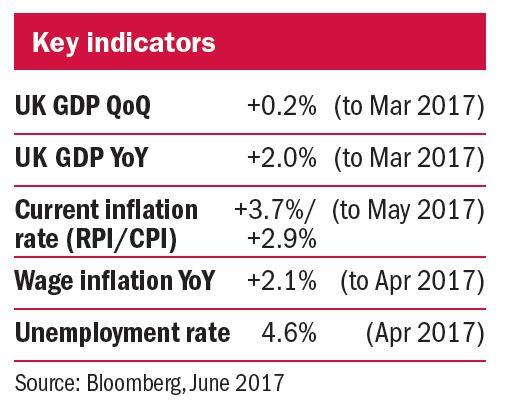

Increased government spending and debt levels are likely to be a feature of the economic landscape, including in the UK. Meanwhile, despite nascent inflationary pressures, it is difficult to conceive an aggressive counter move from central banks that would catapult real interest rates (base rate minus inflation) into positive territory.

Real interest rates still negative

Real interest rates have remained firmly negative since 2009. We expect this environment of so-called financial repression to continue for the foreseeable future, meaning ongoing subsidisation of debt holders by depositors. Even stretching out to an investment in a ten-year UK gilt would lock in a little under 1 per cent per annum. In the face of what are likely to be increasing inflationary pressures, we therefore continue to seek safety in index-linked gilts.

It is notable that equity markets continue to take political shocks and geopolitical tensions in their stride, and with interest rates and bond yields seemingly nailed to the floor, global stock markets are reaching new highs, arguably with unnaturally low levels of volatility. However, while equities will remain a core allocation for the majority of endowments, it is essential in our view that this sits within a mix of protective assets.

Christopher Queree is investment director at Ruffer – www.ruffer.co.uk