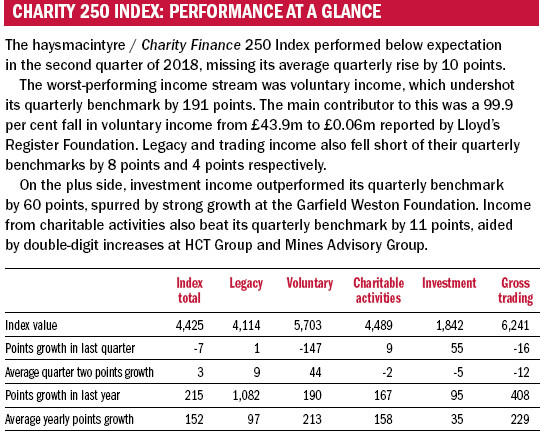

A key contributor to the decline in the haysmacintyre / Charity Finance 250 Index in the second quarter of 2018 is the 81 per cent fall in income to £10.3m reported by the Lloyd’s Register Foundation.

The fall resulted from a near 100 per cent fall in Gift Aid from its trading subsidiary, Lloyd’s Register Group, from £43.9m to £0.06m. According to the trustees, the £43.9m figure reflected “a particularly strong UK profit performance in 2015-16, which was not repeated”.

As the foundation holds sufficient funds to continue its immediate grant-making activity, the trustees have decided that profits generated by the trading subsidiary in 2016/17 should be reinvested to secure long-term growth and increased profitability in the future rather than paid to the foundation as Gift Aid.

Large double-digit falls in income were also reported by the Against Malaria Foundation and Business in the Community (BITC).

The Against Malaria Foundation reported a 28 per cent fall in income to £26.1m, resulting largely from a £12.6m reduction in the value of £0.75m-plus donations. On the plus side, the value of funding generated by donations of less than £0.75m increased by 20 per cent, while the overall number of donations increased by 13 per cent.

BITC saw its income fall by 25 per cent to £19.8m, largely as a result of the transfer of the Prince’s Countryside Fund and its trading subsidiary Countryside Fund Trading to the Prince of Wales Charities Foundation at 1 July 2017.

Conversely, large double-digit rises in income were reported by the Mines Advisory Group, Charities Trust and HCT Group. The biggest increase was reported by the Mines Advisory Group, which saw its income increase by 30 per cent to £60.9m. The rise resulted from increased programming activity, funded by grants and contracts, in Syria, Iraq, South Sudan, Chad, Nigeria and Bosnia.

Grantmaking charities

Within the Charity 100 and Charity 250 Indexes, there are more than 20 grantmaking trusts or foundations which raise funds to donate to other charities that are more directly involved in service provision. They range from the Wellcome Trust, with annual income of £484.8m, to the Lloyd’s Register Foundation, which has an annual income of £10.3m.

Although they share a common remit, there are a broad range of types of foundation. They include family or family business foundations, such as the Gatsby Charitable Trust, set up by David Sainsbury, and the Leverhulme Trust, set up by William Hesketh Lever, the founder of Lever Brothers.

They also include corporate foundations such as the Lloyds Bank Foundation and the Lloyd’s Register Foundation, along with fundraisers such as Charity Projects (Comic Relief) and BBC Children in Need.

Investment and voluntary income are the two main sources of income for this segment. Investment income accounts for more than 80 per cent of income at the Wellcome Trust, the Children’s Investment Fund Foundation (UK), the Leverhulme Trust, the Garfield Weston Foundation and Bridge House Estates.

Voluntary income accounts for over 80 per cent of income at BBC Children in Need, Comic Relief, the Gatsby Charitable Foundation, the Lloyds Bank Foundation, the Amanat Charity Trust, Lempriere Pringle 2015 and the Allchurches Trust.

Income streams can be more mixed, as they are for example at the Rothschild Foundation, which generates 40 per cent from trading, 31 per cent from investment income, 19 per cent from voluntary sources and 10 per cent from charitable activities. This is not, however, typical.

The sector as a whole is fairly buoyant. According to the Association of Charitable Foundations (ACF), grantmaking by the top 300 foundations rose by 10.9 per cent in real terms in 2016/17 to a recordbreaking £3.3bn, accounting for 90 per cent of all foundation giving.

Underpinning the rise in grantmaking was a 9.6 per cent real increase in total income to £3.7bn in 2016/17. Income from both investment and voluntary streams increased strongly at 10.7 per cent and 10.3 per cent respectively.

In the face of pressures on other sources of income – particularly government funding – demands on grantmakers are also increasing.

“In the current economic climate, the volume of grant applications is growing and many grantmakers are taking steps to streamline the process by making funding criteria and the application process as clear as possible to new applicants, often via online tools and videos,” says haysmacintyre senior audit manager Siobhan Holmes.

“At the same time, grantmakers are keen to demonstrate that they are spending their money responsibly,” she adds. “This can be quite challenging as they need to report not only on how they have allocated their funding but also on what recipients have done with it. We are seeing much greater emphasis on impact reporting as a result.”

|

Related articles