As politicians made their return after a quiet summer of recess, there was an escalation in geopolitical tensions with North Korea. Although markets resisted the urge to panic over any “mutual self-destruction” scenario, some fearful investors sought disaster protection sending the traditional safe haven asset – gold – to 18-month highs.

It wasn’t long before focus shifted to the storms tormenting the Caribbean and Eastern seaboard and the disaster relief that would shortly be required. President Trump looked to stamp his authority, linking suggestions of a support package to an extension of the debt ceiling in the US. Commentators suggested that this might be a precursor to a larger spending push from the President.

This came amid continued speculation as to the fate of the Federal Reserve’s balance sheet and the resignation of Janet Yellen’s right-hand man Stanley Fischer. This leaves the door wide open for President Trump to be instrumental in determining the future of US monetary policy by filling four out of seven Fed governor seats and potentially the Fed chair itself.

Contrary to his campaign narrative, Trump appears to be an advocate of keeping interest rates lower for longer, and we expect this to inform his nominations. Meanwhile, the ongoing speculation dictates the path of the US dollar.

A resurgent euro

Turning to Europe, the question of policy tightening is also very much on the agenda, although the resurgence of the euro, now at a two-and-a-half-year peak against the US dollar, remains something of a mixed blessing for Mario Draghi and the European Central Bank. The immediate impact of this euro strength has been to dampen rising inflationary impulses; eurozone inflation at a little over 1 per cent remains below the ECB’s 2 per cent target.

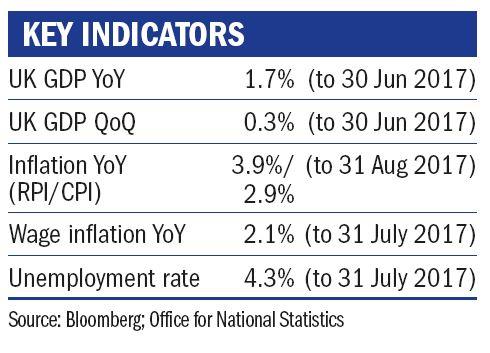

Conversely, in the UK in August, a sharp increase in clothing prices, partly due to the post-Brexit depreciation of sterling, led UK inflation to one of the highest levels seen in the last five years. The somewhat unexpectedly hawkish tone from the recent Bank of England meeting steered market expectations towards the probability of an interest rate hike in November. Despite this, we believe that mounting pressure on the public sector pay cap and expectations of fiscal stimulus in the Autumn Statement mean domestic inflationary pressure will continue to build.

Jenny Renton is an investment manager at Ruffer – www.ruffer.co.uk