The monetary policy committee has now reversed the post-referendum, 0.25 per cent cut of last June, and markets anticipate a further nudge up to 0.75 per cent in 2018. However, these predictions are not always borne out, and with Brexit negotiations seemingly still at something of an impasse, the Bank may wish to retain flexibility even at the risk of once more being labelled the “unreliable boyfriend”.

Adding to the impetus for an upward move was a revelation from the Office for National Statistics that previous data for unit labour costs had been understated, and that labour cost for the three months to June amounted to 2.4 per cent rather than the previously stated 1.6 per cent.

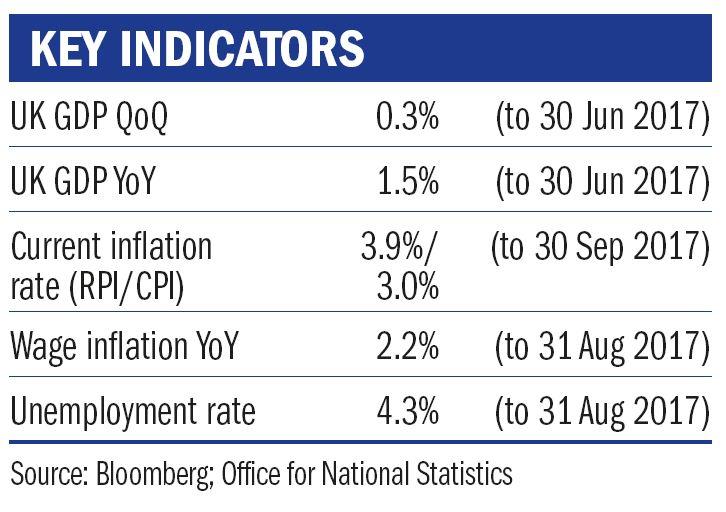

With UK unemployment at its lowest level since 1975, it appears that the traditional economic dynamic between the unemployment rate and the inflation rate (the socalled Phillips Curve dictates that the lower the former, the higher the latter) is possibly changing or moderating in some way. This phenomenon continues to puzzle economists both here in the UK and the US – unemployment has fallen to nearly 4 per cent in both countries, but inflation has remained relatively subdued, particularly in the States.

Tapering has begun

With “tapering” of the balance sheet (selling bonds that were bought to stave off the financial crisis) now underway by the Federal Reserve in the US, this is also on the agenda at the European Central Bank. Meanwhile in the UK, September saw further encouraging inflation figures, adding to the impetus for an interest rate rise and suggesting we are in the early stages of policy “normalisation”.

However, the latest quarterly missive from the Bank for International Settlements (BIS), often referred to as “the central bankers’ bank”, provides a salutary reminder of the underlying structural issues within the global economy and the tensions faced by authorities as they attempt to wean the economy and indeed investors off “emergency” level interest rates.

Christopher Querée is head of charities and investment director at Ruffer – www.ruffer.co.uk