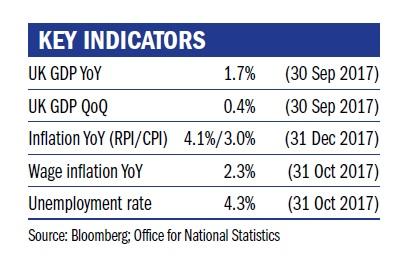

Spurred on by the Bank of England’s 0.25 per cent rate hike in November, sterling has continued to strengthen. Indeed, it is notable that while the Brexit-bound economy hardly falls into the category of a “global growth leader” for 2017, the data – expected to be confirmed at around 1.7 per cent GDP growth – is far from the disaster predicted by many.

Equally, with some tentative positive momentum in the Brexit negotiations achieved at the year-end, sterling evidently caught out some “short sellers” – it rallied as speculators had to buy back the currency to cover their positions.

Meanwhile, inflation in the UK has remained stubbornly ahead of the Bank of England’s 2 per cent target, with the retail price index averaging at 4.1 per cent for 2017. UK wage growth averaged nearer 2 per cent to leave real incomes in noticeably negative territory.

This matter of declining real incomes is now firmly on the political agenda, and while some short-term relief may be felt as a result of increased stability in sterling, it would seem that the pressure for a political response to it could in the longer-term have more significant implications.

In the United States, the approval by the Senate of President Trump’s corporation tax cuts from 35 to 21 per cent represents a radical political intervention in the economy, but the ultimate impact on the average worker in the US rust belt is yet to be seen. While some US corporations have already announced that they will be sharing some of this windfall with employees in terms of bonuses, it is too early to conclude that this will do much address the real wage growth contraction experienced by a large swathe of the workforce.

That being said, there remains hope that a friendlier fiscal environment might encourage corporate investment that in turn could improve productivity and address the negative wage phenomenon that has been the scourge of western economies for some time.

Back in the UK, the December meeting of the Bank of England’s Monetary Policy Committee (MPC) saw all nine members vote unanimously to leave interest rates unchanged, despite the target data mentioned above. The MPC’s expectation seems to be that the devaluation in sterling accounts for the shorter-term inflation which will soon be behind us.

Christopher Querée is investment director at Ruffer.