Key physical, economic and social trends, often grouped under the heading of sustainability, are increasingly material to investment returns and risks across asset classes. The value of a portfolio will be sustained over many decades only if it is invested in assets or businesses that will be at least as relevant to society tomorrow as it is today.

Climate change and the necessity of transition to a low-carbon economy are huge factors, but there are others too, as social changes and technology reshape the global economy. The opportunity today from investing in (and only in) those companies that will be on the right side of history is compelling, as change erodes value in many industries and recreates it elsewhere.

We believe that the materiality of these trends means sustainable investing has moved beyond alignment with ethical considerations to become important to all investors. Today, there is a window of opportunity for investors to gain an advantage as current investment decision-making frameworks tend to be short-term focused and less inclusive of all the material data.

Climate change

Climate change is now economically material and something that all investors can act on, as the potential to shift to a global low-carbon economy will have clear winners and losers. In our opinion, an understanding that climate change is an enduring and material investment issue can give investors an advantage.

Climate change has two kinds of impact: the physical, resulting from changing temperature and weather patterns and the transition risks that result from efforts to move to a lower-carbon economy. It is important to recognise that these are both inevitable. There will be increasing efforts to limit atmospheric carbon, but these will not be enough to stop some degree of climate change, which is already happening.

The speed with which our understanding is changing plus inherent conservatism and a silo mentality in the finance industry mean these risks are not correctly valued in asset prices. For that reason, investors would benefit from incorporating these risks as a new pillar of their risk allocation framework; that way, they can construct diversified, resilient portfolios aimed at outperformance.

And it’s not just climate change

The existential scale of the climate issue can put other sustainability issues into the shade but they are, nevertheless, important. Moreover, they are increasingly linked together.

The expectations that society places on companies around social and environmental issues broadly are rising. Material environmental and social externalities, degrading the environment or causing social harm, have not been properly accounted for by many companies. This has allowed some less sustainable companies to over-earn according to research by Morgan Stanley.

Greater socioeconomic accountability is changing the competitive dynamics, turning former winners into losers. This pressure from stakeholders can come from regulators, governments, legal claims, NGOs and (in a world of social media connectivity) increasingly from consumers as well.

Our stable climate is not the only natural resource being degraded. The broader problem poses material risks for companies whose core activities are not sustainably using these resources and opportunities instead for those promoting resource-efficient growth. Such solutions will occur not only in the energy and power sectors but also within sectors such as industrials, transportation, manufacturing, agriculture and real estate.

Potential externalities that could be mispriced could include plastics pollution, irresponsible marketing of tobacco products in emerging markets, greater regulation and public awareness against food harmful to health, unsustainable agriculture, and the environmental footprint and social cost of the fast-fashion business model.

Technology is an insufficiently emphasised enabling factor here. The scale for potential disruption of existing businesses and traditional industries is now well understood; the evidence is before our eyes. But how is this related to sustainability?

Technology reshaping entire industries is the glue that binds together nearly all solutions for a more sustainable economy, which means there are huge investment opportunities in solving global challenges at the interface of technology and sustainability. The potential of technology to move today’s linear economy (make, use, dispose) to an asset-light circular economy that minimises waste and makes the most of resources by recovering and recycling them is substantial. This transformation has very disruptive implications for asset-intensive business models.

Evidence of impact

The argument for using sustainability as a framework for investment decision-making is an economic one, driven by evidence. One way we see how basic economics is driving returns is through our database of investment manager returns. We recognise the pattern, because we have seen it before.

For example, rapidly falling costs in areas such as gene sequencing rapidly fed through to a reversal of fortune in healthcare venture capital investing, taking it from below average in the 1990s to above average for the past ten years. This same relationship between innovation, scale and cost can now be seen in large and significant cost reductions in clean technologies.

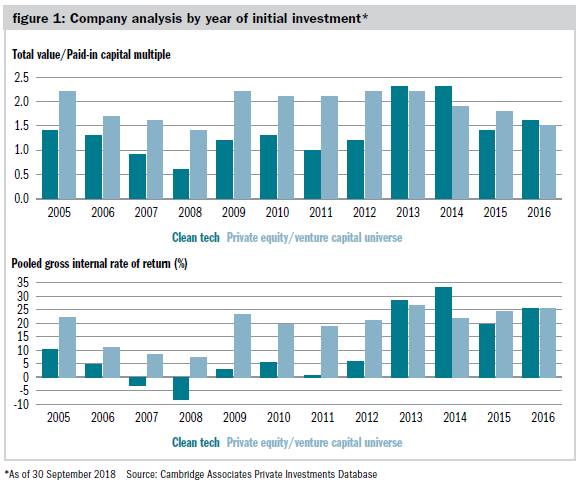

This is reshaping the economics of sustainable businesses, and the underperformance of capital-intensive or subsidy-dependent clean technologies a decade ago is disappearing. Investment returns from private clean tech companies have increased sharply in the latest vintages.

After negative or single-digit returns in the early years, the pooled internal rate of return (IRR) of underlying clean-tech investments jumped up to over 28 per cent in the 2013 vintage. It has remained at elevated levels, outperforming the broader universe of companies backed by private equity or venture capital in three of four vintage years since.

Just as important as the positive opportunity is the management of risk. The decline in economics for poorly positioned companies can be rapid. A key factor in the roughly two-thirds decline in the market value of General Electric since 2016 was the exposure of its power division to thermal generation, which has rapidly lost market share to renewables in recent years.

Again, while climate change is a huge factor, it is not the only significant ESG investment risk. Bayer underestimated the externalities from the potentially toxic and carcinogenic glyphosate fertiliser Roundup when it paid $63bn to acquire its maker Monsanto in June 2018. When subsequent court judgments went against Monsanto, investors scrambled to cost 13,000 related court cases and countrywide bans of the product. As of June 2019, Bayer shares had lost roughly 50 per cent of their value since the acquisition.

Multi-stakeholder accountability means a single incident can grow into industry-wide transformation. For example, the 2015 Dieselgate emissions scandal at Volkswagen (VW) first hit the stock; it then acted as a catalyst in focusing attention on health concerns over diesel emissions, which in turn led to more taxes, restrictions and even bans on diesel vehicle use in many countries, resulting in material falls in diesel car sales across Europe.

Why these factors may be mispriced

While the materiality of sustainability trends is insufficient for investors, we must also justify why sustainability is also being poorly understood and mispriced.

Short termism and narrow focus

Financial valuation models are typically based on three-to-five-year horizons, with subsequent linear extrapolation. This is not surprising, as the average holding period of institutional investors is now around 1.5 years for both equities and corporate debt; but it explains why material factors can often be overlooked and mispriced. Many sustainability risks may be slow building and with a sudden crystallisation (like Bayer’s and VW’s problems above).

Mark Carney, the governor of the Bank of England, has repeatedly warned of a future climate Minsky moment, using the term to describe a collapse in asset prices based on Hyman Minsky’s theory of financial crises.

Behavioural biases

Investors or lenders may not correctly assess the materiality of emotive issues. Vested interests and politics can also obscure economic arguments relating to sustainability. The potential unsustainability of a fossil fuel-based economy and issues such as stranded assets can be not only emotive but also a controversial or even taboo topic for investors happy to take clear positions on other disruptive trends. This is a completely understandable bias given that our entire economy and wealth was historically built on fossil fuels.

Too much wrong data and too little good data

Sustainability trends are material and directional. They also take us somewhere new. This implies that historic data may be less useful alongside assumptions and extrapolations based on this data, such as reversion to the mean. It also implies a need to embrace uncertainty and fundamental change.

Where there is useful data, it is often new and therefore open to questioning. This can be a serious impediment to decision-making. Consider that the four hottest years globally in recorded history were the last four years, while the 20 warmest years on record have been in the past 22 years.

Maverick risk may be required

Maverick risk is the risk of being different from the pack. Given the materiality of sustainability trends, the neutral position of owning the market passively is no longer a safe place to be. In investment terminology, this means embracing sustainability entails taking on substantial amounts of tracking error risk. Not all investors are ready for this, particularly now given the substantial rise in passive investing.

Conclusion

Debate on this subject has often been framed as a trade-off between return maximisation and sustainability; we think differently. There are clear, directional sustainability trends that will not revert to the mean and will take the investment landscape somewhere new. These trends can be mispriced. Wise investors will aim to avoid risks and exploit the investment opportunity and thereby build resilient portfolios.

Simon Hallett is head of European endowments & foundations at Cambridge Associates

Charity Finance wishes to thank Cambridge Associates for its support with this article