Most stock markets have enjoyed strong performance over the past few years. The same cannot be said for the UK, which has languished. Years of political deadlock and the prospect of Brexit made the UK uninvestable for many.

But the General Election is now in the rear-view mirror, and a majority government is in power. This provides some certainty as to who will be forming policy for the next few years. And markets like certainty, as seen in their immediate reaction the day following the election. That being said, UK equity valuations are still attractive when compared to other stock markets globally.

Signs of stronger domestic growth would see “UK plc” perform well, but thus far this growth is somewhat lacking. Two Brexit deadlines made analysing UK economic data difficult in 2019, but even as the effects of these distortions dissipate, UK GDP growth seems to be slowing. The Bank of England is now considering cutting interest rates at the end of January in the face of weaker economic data – the CPI inflation measure fell to its lowest level in more than three years in December.

Other risks

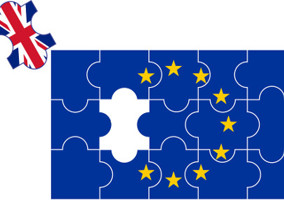

Other risks remain in addition to this. There is still uncertainty surrounding what kind of Brexit will be negotiated with the European Union.

In a recent speech at the London School of Economics, European Commission President Ursula von der Leyen made clear the difficulties of arranging a trade deal with the EU before an ambitious December 2020 deadline. The final format of any deal will have a significant bearing on the performance of UK companies, and one can expect volatility on the road ahead.

However, on the election campaign trail the Conservative Party made spending promises that would mean the application of significant fiscal stimulus. They managed to win historically staunch Labour constituencies with the help of such promises, and they now have to fulfil those in order to keep their newly won voters on-side. This is likely to take the shape of infrastructure spending and tax reform, which will be announced in greater detail at the next Budget this March. Such a bout of stimulus could kick-start the UK economy, which in turn would be a boon for the UK equity market.

Charles Auer is an investment associate at Ruffer – www.ruffer.co.uk

Ruffer LLP is a limited liability partnership, registered in England with registered number OC305288 authorised and regulated by the Financial Conduct Authority. The information contained in this article does not constitute investment advice or research and should not be used as the basis of any investment decision.

|

Related articles