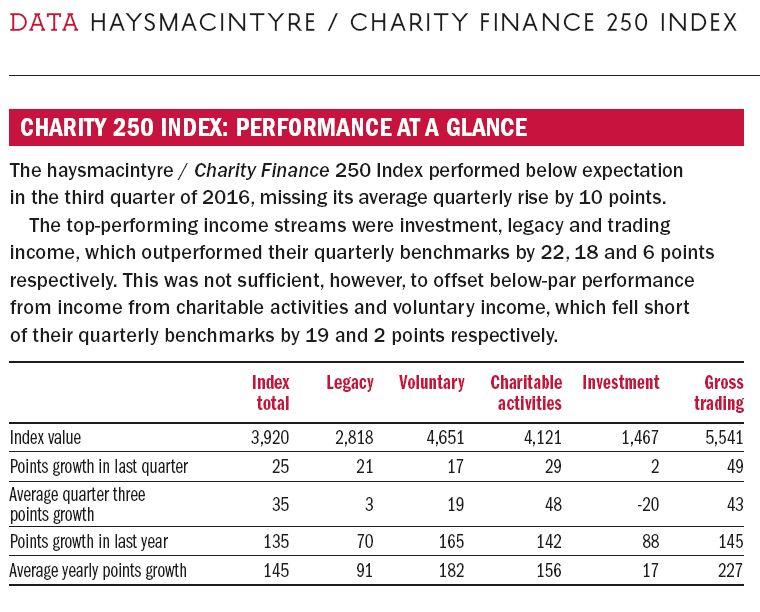

This quarter has seen impressive income rises of 25 per cent or more at the Royal Academy of Arts, the Kennedy Trust for Rheumatology Research and Stowe School, despite otherwise below-average results across the haysmacintyre / Charity Finance 250 Index.

The star performer in the quarter under review is the Royal Academy of Arts, whose income has risen by 47 per cent to £58.4m. This was largely as a result of a £13.5m funding injection from the Royal Academy Development Trust, a separate charity set up in 1981 to support the Royal Academy.

The bulk of this – some £12.8m – is for the Burlington Project, which involves the redevelopment and refurbishment of the Royal Academy’s buildings and estates and is due for completion in 2018. The arts charity has also benefited from a 20 per cent increase in trading income to £11.4m, boosted particularly by a strong increase in online sales.

Another strong performer in the quarter under review is the Kennedy Trust for Rheumatology Research, which reported a 31 per cent increase in income to £37.3m. This was due to a 34 per cent increase in income from medical research patent royalties to £33.3m, which represents almost 90 per cent of the charity’s total income. As this figure includes “a one-off payment received from one of the Trust’s licensees to settle various royalty issues”, it is possible that this rate of increase is a one-off and may not be sustained.

The third biggest income rise was reported by Stowe School, which posted a 25 per cent increase in income to £27.3m. This was due to a 15 per cent increase in school fee income and a near quadrupling of voluntary income donated by the Stowe Schools Foundation.

The independent schools sector represents around three-quarters of Charity 250 Index charities reporting their results in this third quarter. It is therefore unfortunate, though not surprising, that Stowe School’s financial results are not typical of the sector as a whole. Indeed the median annual income change for the independent schools represented in the Charity 100 and Charity 250 Indexes is a much more modest 4 per cent increase, down marginally from 5 per cent last year.

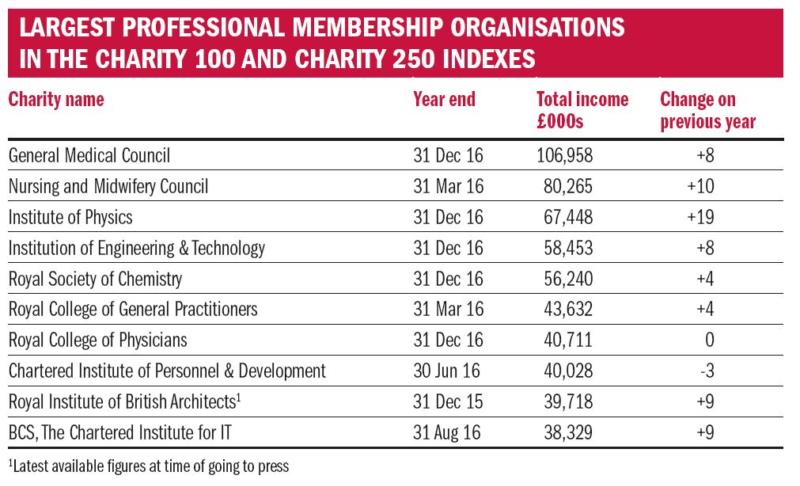

Looking ahead to charities that report their results in the fourth quarter, sectors with strong representation include religious organisations and professional membership associations.

Membership organisations

Across both the Charity 100 and the Charity 250 Indexes, there are almost 20 professional membership organisations. These range from the General Medical Council and the Nursing and Midwifery Council in the Charity 100 Index, with annual income of £106.9m and £80.3m respectively, to smaller associations with annual income of £23.6m and above.

Given the broad range of professional associations in the UK, this may be fewer than one might initially expect, but not all professional associations are charities. While professionals active in sectors such as healthcare, science, engineering and accounting are well represented in the indexes, professionals active in equally broad sectors such as law are not.

Charitable status does of course confer many benefits, not least eligibility for wide range of funding sources and tax relief, but the requirement to exist for the provision of public benefit rather than the private benefit of a special interest group can be restrictive and outweigh these benefits. “Charitable status places increased regulatory requirements on professional membership bodies and subjects them to increased scrutiny,” says haymacintyre partner Kathryn Burton. “It is not always advantageous for organisations that see themselves as first and foremost for their members.”

A key feature of professional membership bodies is their reliance on membership fees and the relative underdevelopment of other income streams, such as trading, voluntary and investment income. Taking all professional membership bodies in the Charity 100 and Charity 250 Indexes as a composite, income from charitable activities accounts for 83 per cent of income, followed by trading income at 14 per cent, and the remaining 3 per cent split between investment and voluntary income.

As a significant proportion of a professional association’s income derives from membership fees, organisations where professionals must be registered in order to practice are more insulated from pressures on this income stream than organisations where membership is voluntary. However, they may face other pressures. Professional bodies operating in sectors such as healthcare, which rely heavily on immigrant workers, are also reliant on rules which allow freedom of movement for foreign workers to enter the UK, which are likely to change as the government negotiates its exit from the European Union.

“Professional associations need to retain and grow their membership base, but at the same time they need to develop other income streams so that they are not overly reliant on fee income,” says Burton.

Exemplars

As one might expect, there are some examples of good practice represented in the Indexes. The Chartered Institute for Public Finance and Accountancy (CIPFA), for example, earns over half of its income – some £12.8m – in the form of trading income from information, advisory and property services. Similarly, the Chartered Institute for Personnel and Development (CIPD) earns almost 40 per cent of its annual income – a chunky £15.3m – from trading subsidiaries active in the UK, Asia and the Middle East.

Collaboration with other membership bodies and related organisations, both at home and abroad, has proved to be a key strategy for adding value to the services provided to the membership.

A prime example domestically is Charles Darwin House in London, which accommodates several professional associations active in biosciences. This premises-sharing arrangement enables the associations to share costs and promote their services to interested parties beyond their individual memberships. Meanwhile, cross-border collaboration between professional membership bodies can underpin a wide range of knowledge transfer initiatives. However, it is often concerned with qualification accreditation and enabling professionals with qualifications gained in one country to have them recognised and accepted in another. This too is an area that is likely to be affected by any changes to the freedom of movement rules, as the government implements its Brexit strategy.

Looking ahead

Looking ahead, compliance with the General Data Protection Regulation (GDPR) will be a key issue for professional organisations that hold extensive and detailed information on their members.

“The risks of non-compliance in this sector are severe”, says Burton. “A professional organisation that had to inform its entire membership of a data breach would find it very difficult to recover, so we are seeing some very detailed GDPR action plans and best practice implementation in this sector.”