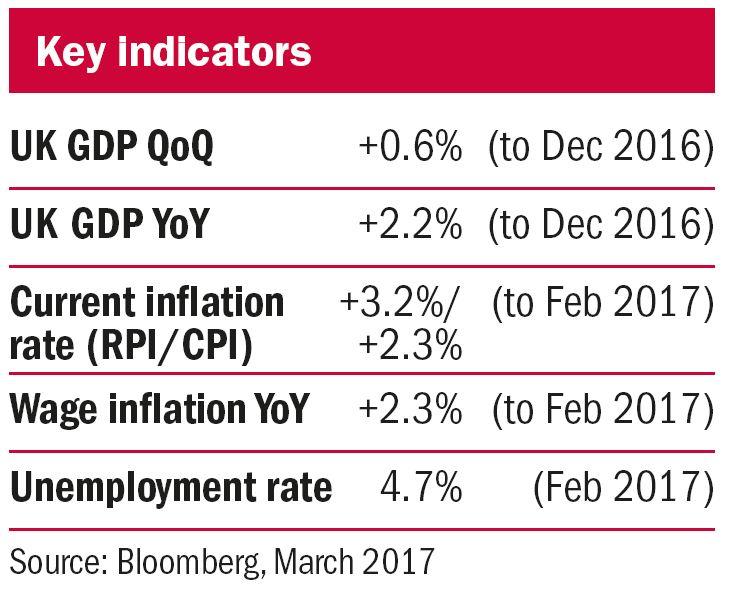

In another indication that the global economy has started 2017 with momentum, the UK unemployment rate has fallen to 4.7 per cent, the lowest since August 1975. We are now focusing on whether the current economic strength can be sustained.

As activity has picked up, so too has inflation – although much of the move so far has been from oil price increases. Rising inflation provides a direct threat to conventional bonds and to consumer spending. This could impact on corporate earnings and equity markets.

Will politics compel volatility?

The Dutch election result prevented the anti-immigration Freedom Party from gaining power and reassured those concerned about the rise of more populist anti-EU governments. However, the future of the EU and the stability of the euro are perceived to be potentially at stake from upcoming elections in France and Germany this year. There could be significant consequences for the region should Marine Le Pen’s Front National win in France – a possible outcome, though not our central scenario.

Despite political upheaval over the past couple of years, stock market volatility has been staggeringly low. According to the Financial Times, if at the start of 2011 you had predicted that volatility would fall, investing in the relevant index would have earned you almost 32 per cent per annum since then.

The strengthening economic backdrop is positive for corporate earnings, and the prospect of expanding fiscal policies supports equity markets. We are cautiously optimistic about equities, and retain our position in order to benefit from earnings strength and positive sentiment. Inflation and political risk in Europe are headwinds for conventional bond markets and we continue to advocate an underweight position to fixed income overall, with a preference for corporate over government debt. UK commercial property capital values have been supported by overseas investors, as sterling weakness has discounted UK property assets. Our charity portfolios continue to be diversified, with allocations to alternative investments to dampen volatility.

Emily Peterson is a portfolio manager at Cazenove Charities

Related articles