There are always challenges when constructing a portfolio but events since the great financial crisis mean today’s problems are genuinely without precedent. Persistent record low interest rates, negative in some places, play havoc with portfolios that need income or, indeed, return. But this problem comes after many years of bonds being remarkably good investments. After all, you don’t get to record low interest rates without record-breaking performance from owning the instruments that provide the interest.

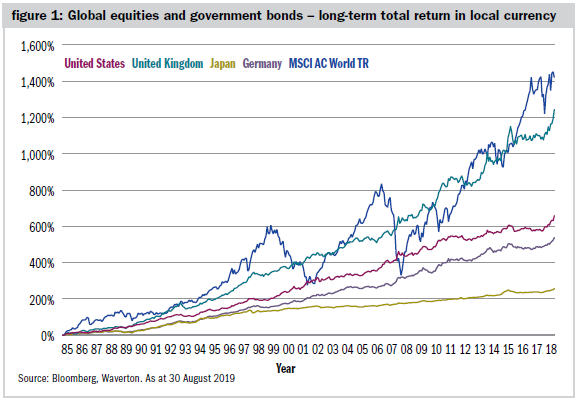

Figure 1 shows the total return of UK, US, German and Japanese government bond markets and the MSCI All Country World Stock Market index. Since 1985, the MSCI index has returned 8.4 per cent per annum. Remarkably the UK gilt market has returned 8.0 per cent.

The gilt market has given that return at much lower volatility. But from here it is difficult to see how bonds can produce much of a return. For example, from the current level of yields, a ten-year gilt will give you a return of only 0.6 per cent per annum in nominal terms, even if the yield goes to 0 per cent over the next six years. This represents a 1.4 per cent annual loss in real terms if we assume an inflation rate of 2 per cent.

Apart from the return challenges for gilts today, other issues mean that not only will the green line in the above chart not be going up like it has been but it will also in all likelihood become more volatile.

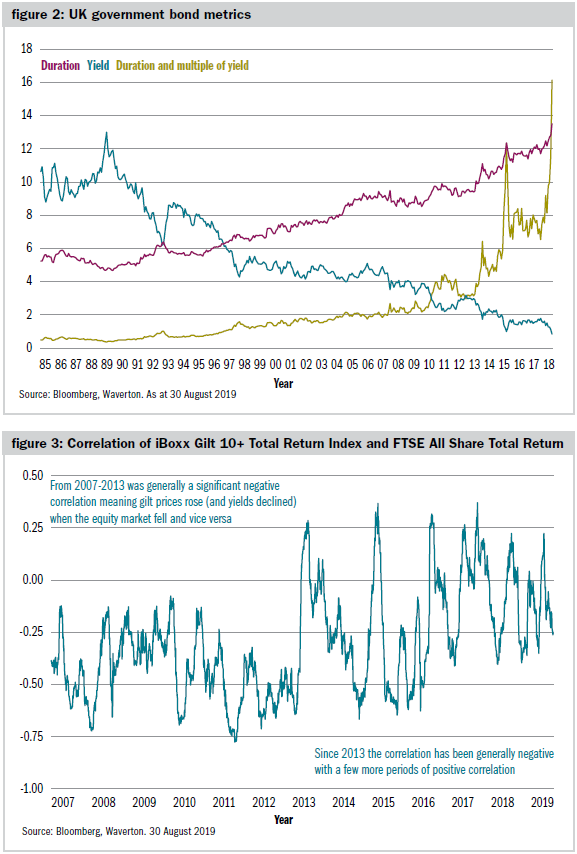

Figure 2 shows that the gilt market has changed in important ways in recent years. Not only has the yield fallen but the duration of the overall gilt market has been rising. It makes sense for the government to lock in record low interest rates for longer periods of time by issuing more long-duration bonds and fewer short duration bonds. The duration of the overall gilt market has doubled since the early 1990s.

But the combination of falling yields and longer duration means, by one measure at least, the risk in the bond market has risen significantly. The yellow line above shows duration as a multiple of yield. That measure tells you how many years’ worth of income you will lose if yields rise by 1 per cent. So if gilt yields rise by 1 per cent today, you will lose 17 years of income. This is something of an existential problem for investors who have seen a bond bull market for nearly four decades (and that is most investors).

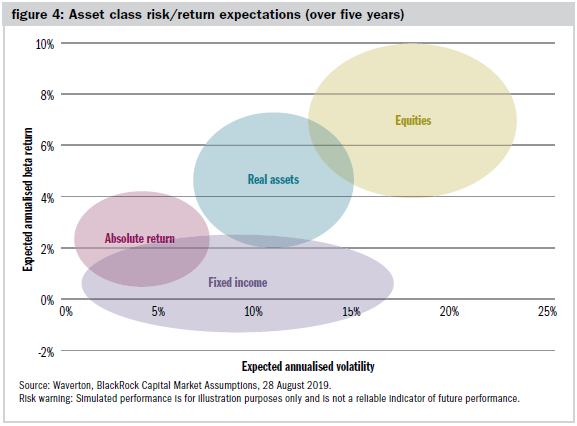

While all the above is true, some people argue that the return generated by bonds has been a bonus. Bonds are owned as a diversifier, reducing volatility in the overall portfolio by being negatively correlated with the equity market and therefore doing well when equities do badly. It is worth owning bonds if they do that job even if their expected return is very low.

Unfortunately, the gilt market has not been doing that job consistently in recent years. Figure 3 shows the rolling 60-day correlation of the daily move in the FTSE All-Share Total Return Index and the move in the All-Gilt Total Return Index. Between 2007 and 2013, the two were always negatively correlated. So throughout the financial crisis and the euro crisis, gilts did what you wanted them to do. They provided a positive offset to the losses incurred in equities.

But since 2013, the relationship has become unreliable. Our view is that it will continue to be unreliable given such low rates and the elevated duration in the overall market.

How alternatives can be part of the solution

We do think that an actively managed bond portfolio still has a role to play in meeting investor goals. But we also need to be using other investments to seek a combination of income, return and diversification from equity risk. Our solution is to use a mixture of absolute return and real asset investments to sit between equities and bonds and offer us the characteristics we need.

Absolute return strategies have had a difficult time in recent years. Funds that aim to make money in all-market environments have generally struggled to do that. Many have struggled to generate a return above the rate of inflation. Indeed by one measure (absolute hedge indices) none of the ten different strategies measured covering a universe of hundreds of funds had a positive return in 2018.

The role of real asset investments is to provide a return from things such as property, infrastructure, asset finance, specialist lending and commodities. These are predominantly investments underpinned by physical assets, often with inflation-linked cash flow streams, designed to provide a real total return over the medium-to-long-term. Such investments do correlate to the economic cycle so they will do better when there is positive growth. However, they are not necessarily significantly correlated to the equity market (indeed, commodities are often negatively correlated to the equity market).

We expect more money to go into real assets as opportunities to invest are made more widely available than used to be the case. Historically, it has been large institutional investors such as pension funds, insurance companies and sovereign wealth funds that have allocated to these sorts of investments, often in illiquid form. Today, there are many investment trusts and other collective fund vehicles available to give smaller investors exposure, with some liquidity.

Conclusion

Traditional portfolios have benefited enormously from the bond bull market that began in 1981. Today, it appears likely that we are reaching the end of that four-decade run so we have to think about how we can generate the income, return and diversification that bonds used to provide. Increased allocations to both absolute return strategies and real assets have an important role to play in this environment. Some of these investments remain unproven over the long term but we believe they will increasingly become mainstream for all investors, large and small.

William Dinning is chief investment officer at Waverton

Charity Finance wishes to thank Waverton for its support with this article