The Church Commissioners, which manages around £5.5bn in investments on behalf of the Church of England, is to review its investment portfolio in light of an indirect investment into payday lender Wonga, which the Archbishop of Canterbury vowed this week to “force out of existence".

Yesterday, Justin Welby, the Archbishop of Canterbury, told Total Politics magazine that he planned to create a network of credit unions that are both "engaged in their communities and are much more professional".

He said he had met Wonga boss Errol Damelin and had “bluntly” told him: “We’re not in the business of trying to legislate you out of existence; we’re trying to compete you out of existence”.

But his strong and very public warning to Wonga has today been undermined with the news, revealed by the Financial Times, that the Church Commissioners invests in Accel Partners, the US venture capital firm that led Wonga’s 2009 fundraising.

Today, the Archbishop told the BBC Radio 4's that the amount of money which the Church indirectly invested into Wonga was about £75,000. "It shouldn't happen, it's very embarrassing, but these things do happen and we have to find out why and make sure it doesn't happen again."

He said Church investment managers "didn't pick up" that they had put funds in a "pooled investment vehicle" which, through its investments, had bought into Wonga.

Lambeth Palace has said it will ask the Church Commissioners to investigate how the indirect investment into Wonga occurred, and ask them to investigate whether there are any other inconsistencies in its portfolio.

The connections to Wonga are especially embarrassing for the Church in light of the fact that its investment policy advises excluding payday lenders.

The Church is not the first charity to be burned for its investments into Wonga, Sir Mark Walport, director of the Wellcome Trust, was forced to defend the charity’s investment in the online lender after being tackled about it by Labour MP Stella Creasy.

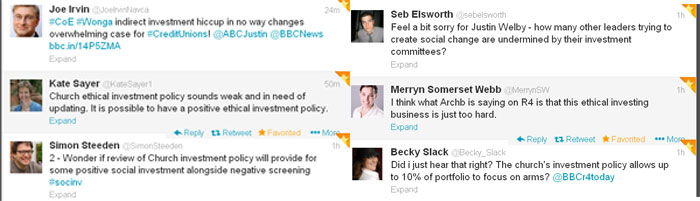

The news on the Church's indirect investment into Wonga has been abuzz on Twitter, with many sector commentators giving views -