Government has not explained why it has chosen to promote social impact bonds, or presented enough evidence as to why they are a better form of funding, according to a free guide to SIBs published last week.

The report, entitled Social impact bonds: an overview of the global market for commissioners and policymakers, is written by David Floyd, managing director of Social Spider, for the Centre for Public Impact at Boston Consulting Group.

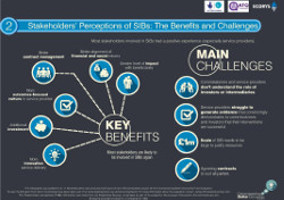

Social impact bonds are a form of payment-by-results contract in which interventions are subsidised by social investors.

The report calls for councils and the government to require recipients of SIB subsidy to publish their results “in a way that enables that data to be more widely used”. It suggests this would be useful in understanding whether social interventions are effective and should be scaled-up or replicated.

It says that every single SIB has so far benefited from public subsidy, but no attempt has been made to explain why or how this is happening. The report calls on the government to explain why it has chosen to subsidise SIBs specifically and how it will judge whether this support has been successful.

Suggested metrics are: increasing the number of outcomes-based contracts; enabling more organisations to take on contracts, crowding in investment into the social investment market.

“Currently the reasons that the UK government has chosen SIBs over alternative funding models are unclear and the mechanisms used to judge whether SIBs work, to a greater extent than other funding models, are also unclear,” it says.

The report also calls for councils and the government to be clearer about their intentions behind funding for SIBs.

“If your council/government is primarily promoting SIBs as a mechanism for trying out a small number of new activities, be open about that.

“If you are genuinely planning to use SIBs/PbR as a new mainstream approach for funding public service be clearer about why and how you are going to do this.”

SIBs have been a controversial measure since their introduction by the previous coalition government in 2010.

See in Charity Finance

While they transfer the financial risk of a social investment being unsuccessful from the government to an independent philanthropist, they are arguable more expensive that other funding mechanisms due to a need for results to be measured.

With government funding only paid when an intervention meets certain outcomes, some in the sector have questioned whether social benefits achieved by social investment schemes can be measured.

There are 32 SIBs in the UK, with an average contract value of just under $6m (£4.8m) and an average investment of just over $1.5m.

Last July, the government launched its £80m Life Chances Fund to underwrite more social impact bond funding.

Related articles