“Diversification,” Nobel laureate Harry Markowitz said, “is the only free lunch in investing.”

But these days, investors who track a stock market index can find themselves with large positions in single shares, which can result in higher levels of volatility – e.g. in January the value of American AI computing firm NVIDIA fell by $600bn in a single day.

Remember the 2000s, when Cisco was the world’s most valuable company, and its network technology ushered in “a new era of computing”? Networks remain a key technology today, but Cisco’s value now is 57% below its peak. NVIDIA may be a similar story.

Tracking a stock market index risks concentration, instead of diversification.

Source: CCLA, MSCI, annual data 31 Dec 2005- 31 Dec 2024

However, there’s no reason to be sceptical about AI, which is probably a key technology for decades to come. But in a fast developing industry, you can expect companies to go through cycles. During the mobile revolution, chip producer Qualcomm was one of the earliest beneficiaries. Phone manufacturers like Apple followed. Finally, service providers like Google and Amazon became dominant.

We believe that the AI revolution will be similar. Semiconductors are the foundation, so NVIDIA’s market cap is one of the world’s largest, for now. But we see the value of AI migrating to cloud infrastructure, like Microsoft Azure and Amazon Web Services. From there, software and service providers like OpenAI may well take over. Because of that cycle, a large investment in a single share, such as NVIDIA’s weight in the S&P500 index, has often been a bad idea.

Quality, at a reasonable price

We believe that over the long term, “quality companies” have a competitive advantage. They grow more quickly and generate more cash than their competitors. Picking such “quality” companies has a long and respectable pedigree among investors who want to avoid the risks that can come with tracking an index.

Take information technology, for example. We use a range of measures that can identify companies with “quality” characteristics.

- Sector leadership. IT market leaders often take c. 80% of a segment’s profits. Their large customer bases often translate into network effects and higher profitability than their competitors. Chip manufacturer TSMC, for example, benefits from sector leadership in semiconductor manufacturing in a way that third-placed GlobalFoundries doesn’t.

- Superior revenue growth. Some companies grow faster than their markets, for example by creating new products for their existing client bases. Automation firm ServiceNow is a good example.

- Financial performance. “Quality” companies often show improving margins and rising cash flow return on investment over time. Cybersecurity firm Fortinet, for example, has expanded its margins over the years. That has boosted its earnings and share price.

- Disciplined valuation. Tracking the index can mean that you invest in speculative shares, whatever their valuation. Instead, investors who focus on “quality” shares may want to focus on reasonable valuations. Even if a company scores well on leadership, growth and cash flows, it can be important not to overpay for it.

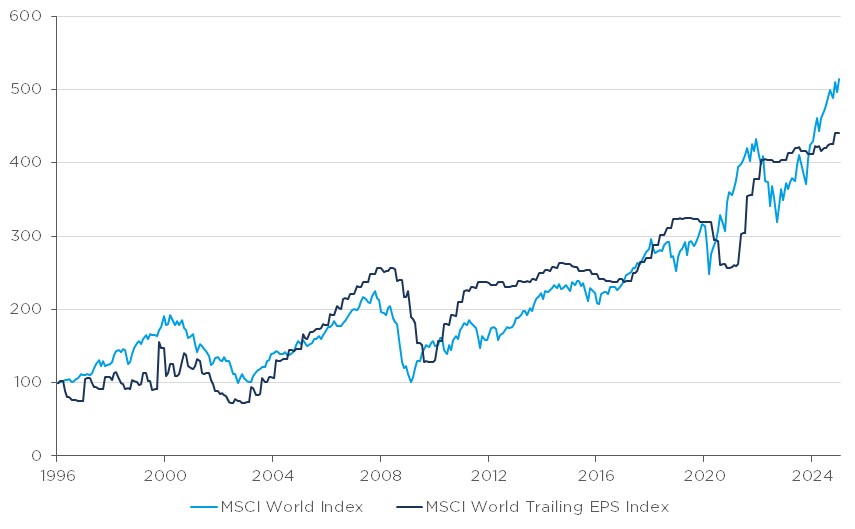

Company fundamentals are key to share prices in the long run.

So how do you capture the AI trend without getting caught out?

In AI, investors can own a broader range of AI firms than Nvidia. For example, ASML, a near-monopoly in semiconductor lithography equipment to print AI chips; Broadcom, a leader in designing proprietary AI chips for Google and Meta; Synopsys, a leader in electronic design automation (EDA); and TSMC, the leading outsourced chip manufacturer. In addition, there are firms like Microsoft, Amazon and Alphabet, who are leaders in cloud computing infrastructure to host AI computing services.

We believe there are two key rules you should adhere to. Identify and invest in quality companies at a reasonable price and maintain a diversified portfolio of investments.