Despite uncertainty, markets have remained buoyant. The Bank of England has raised rates for the first time in a decade. US monetary policy is moving from QE to QT (quantitative easing to quantitative tightening). The problems which have plagued emerging markets for years appear to be lifting, driven not just by high-profile recoveries but by the overall market. What does the future hold for coal, once the bedrock of the global energy system and investors’ portfolios? LGIM discusses key market events and future themes that are shaping their investment thinking from a longer term perspective.

The Bank of England raised rates – what happens next?

The last time the UK saw a rate hike was in July 2007; Gordon Brown was prime minister, the ban on smoking in public places had been introduced a few days earlier, and the first iPhone had recently been launched. The world has changed a lot in the last decade. The decision to raise rates was well anticipated by the market. The initial reaction was for both gilt yields and the pound to fall, as the Bank’s governor adopted a dovish tone. In particular, the monetary policy committee’s removed a statement about expecting interest rates to increase faster than the market is pricing in.

The Bank of England stressed in the press conference that although growth is weak by historical standards, it is not necessarily below trend. Weak productivity and poor demographics are depressing trend growth, keeping unemployment low. This is consistent with our own research that highlights the drag on growth from baby boomers retiring. With Brexit uncertainties also slowing immigration, UK firms report elevated recruitment difficulties, despite weak economic growth.

The Bank of England was also keen to stress that inflation would not return to target unless interest rates were hiked further. The committee broadly agrees with market expectations of another couple of hikes in the next three years. This is consistent with our own expectation of slow rate hikes. Expect the mantra of limited and gradual to be reiterated in the following months.

The Bank is in a difficult position. As a result of a weaker pound and lower trend growth, if it doesn’t raise interest rates, inflation could remain sticky above target. But if it raises interest rates too much, it risks hurting the economy. This suggests the Bank of England will act cautiously.

Looking ahead in international markets

Over the last few months, global growth has broadened and inflation has remained low. When we look at the systemic risks in markets abroad, from the US to China to wider emerging markets, we find that our view is becoming less negative. Despite the ever-present short-term risks bringing uncertainty, we believe that it is unlikely that any of them will escalate materially at the moment, or at least that those risks are appropriately priced into global markets. Two areas where we see potential opportunities are in the US and in emerging markets. As the Federal Reserve gradually withdraws liquidity, this should favour a long stance on the US dollar. In the developing world, the emerging outlook is a little more uncertain but the best it has been for some time.

Quantitative tightening: where next for US monetary policy?

The mystery of quantitative easing (QE) is that no-one really knows how it works. Ben Bernanke, the former head of the Federal Reserve, once quipped: “The problem with QE is that it works in practice, but it doesn’t work in theory”. In principle, the public sector is simply swapping one kind of government liability (bonds) for another (money). Under the expectations hypothesis of the determination of interest rates, this kind of financial engineering should have no impact on yields. So it’s a bit of a puzzle why it seems to have such powerful effects.

Given that economic theory is pretty silent on the benefits of this kind of liability transformation exercise, it is no wonder that there are a series of unanswered questions. Is it the flow of asset purchases that matters? Is it the stock of bonds held by the central bank that matters? Is it the act of creating additional money to finance those purchases? Or is it the signal about interest rate intentions?

This debate is crucial given that the Federal Reserve is now beginning the multi-year process of winding down its balance sheet. After nearly a decade of QE, we are now entering the era of US quantitative tightening (QT).The September meeting delivered the plan laid out in detail in June. Over the next twelve months, the Fed’s balance sheet will therefore shrink by $300bn as maturing securities are not fully reinvested.

There is only limited historical precedent we can draw upon when thinking about the impact on asset prices and the broader economy. A 2015 working paper from Niall Ferguson (among others) suggests we should be cautious: “Historically, balance sheet reduction episodes have gone hand-in-hand with lower growth rates, somewhat lower inflation rates and substantial slowdowns in financial sector lending activities”.

A couple of caveats

First, estimates of the impact of QE on government bond yields are in the range of 50 to 100 basis points. That mixes up the pure flow effect of asset purchases with the signalling effect of lower-for-longer interest rates. As asset purchases unwind, the signalling effect is still in place given the central bank mantra that interest rate hikes will be limited and gradual. Removing the flow only removes the signal if inflation rears its ugly head again.

Second, we question the extent to which equity markets (in particular) have been puffed up by QE. We believe that the majority of the equity price appreciation since 2009 can be explained by earnings growth and normal bull market multiple expansions. You don’t need a QE-based deus ex machina to explain equity returns.

Third, the Fed’s balance has already been shrinking as a share of GDP for the last three years. From that perspective, we’ve been living with QT since late 2014 and it hasn’t exactly been a difficult period for risky assets.

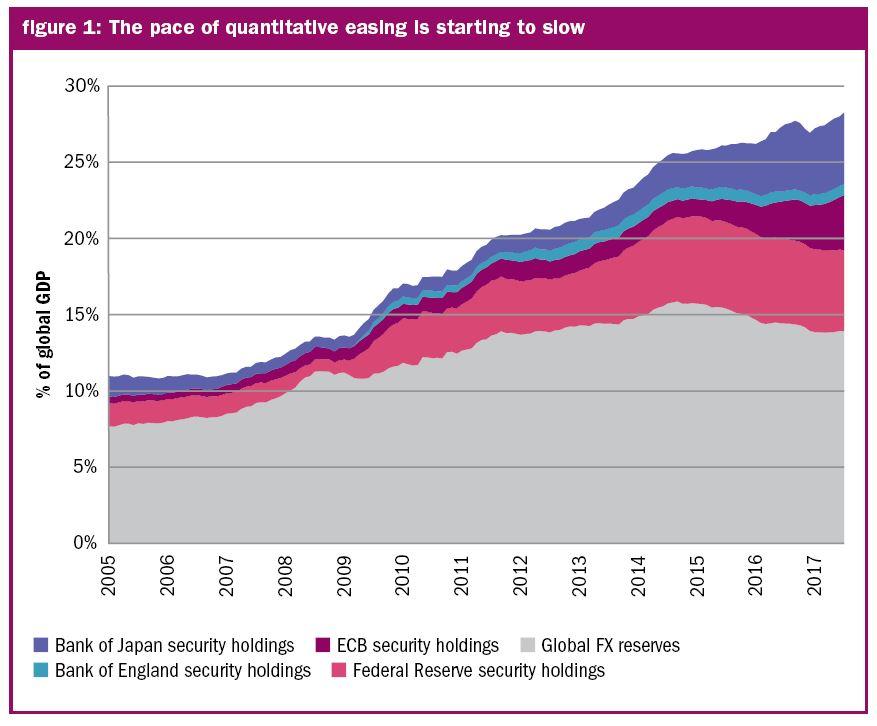

Fourth, at the global level, this is definitely not the end of the story. In our estimates, the European Central Bank and Bank of Japan will collectively purchase the equivalent of $1tn of assets over the next year. On top of that, we may have some reserve accumulation in emerging markets. If those purchases are funded by money printing (rather than sterilised by issuing domestic debt), then it will add further to the global QE flow.

From a global perspective, the QE train is starting to slow down (figure 1). However, it is not likely to come to a standstill until the third quarter of 2018 at the earliest. It looks set to be over a year before it goes into reverse.

So, for QT to have a big impact (at least in the next twelve months), it needs to be because of problems that are specifically associated with a shrinking in the nominal value of the US dollar narrow money supply. We believe those stresses could be seen first in short-dated dollar funding markets (eg. the spread between short-term borrowing rates for the US government and US banks, the spread between the cost of onshore US dollars and offshore US dollars), and the price of the dollar itself.

Consistent with our policy divergence investment theme (and despite little success on this front in 2017) we therefore think it is prudent to continue holding long US dollar positions as a hedge against unexpected strains due to the normalisation of US monetary policy.

A new dawn for emerging markets?

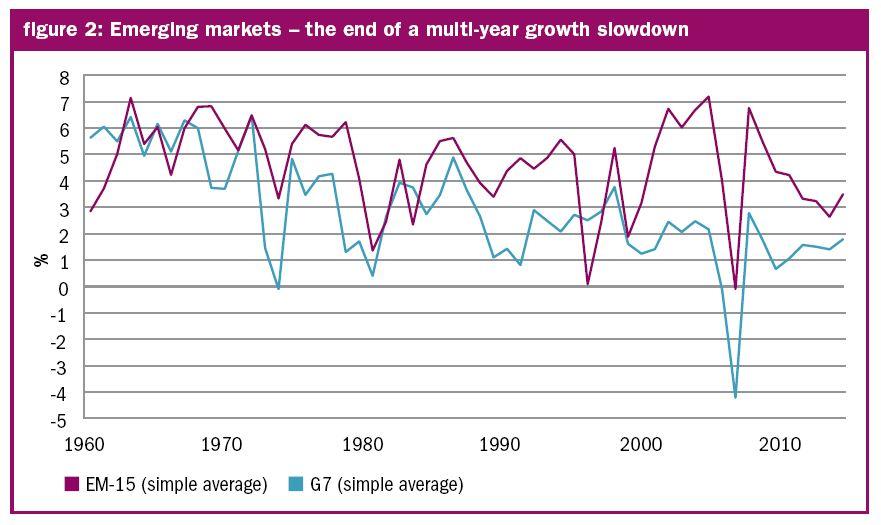

2017 looks set to mark the first year of an emerging market (EM) growth pick-up after six years of successive slowdowns (figure 2). The growth acceleration has not only been driven by the high-profile recoveries of Russia and Brazil; it comprises about 70 per cent of the EM universe. We take this opportunity to ask what lies in store for EM both in the short and medium term.

The short-term EM outlook is closely linked to China’s growth prospects, given their implications for commodity markets. We expect China’s growth to slow very gradually from currently 7 per cent to around 6.5 per cent in 2018 and 6 per cent in 2019. We are worried about China’s debt but, as discussed in various blogs, see state-owned banks and ample fiscal space as potential safeguards against a financial crisis and rapid slowdown.

EMs more broadly have sufficient fiscal and monetary space, which bodes well for shortterm growth. Average government debt stands at 45 per cent of GDP compared to 55 per cent in the early 2000s and 65 per cent in the late 80s. Real policy rates are still far from levels where they constrain growth, providing a sufficient buffer against higher Fed rates.

Most encouraging from a short-term angle is that EMs have started to deleverage since early 2016. By this we mean that their credit gap – the gap between debt-to-GDP and its long-term trend – is falling. This means no more negative growth impulse as long as the pace of deleveraging does not pick up unnecessarily.

EM credit ratings which had been falling since the end of 2014 have been rising again in 2017. They are still firmly in investment grade territory, putting EMs in a better place than they have been for most of their rating history.

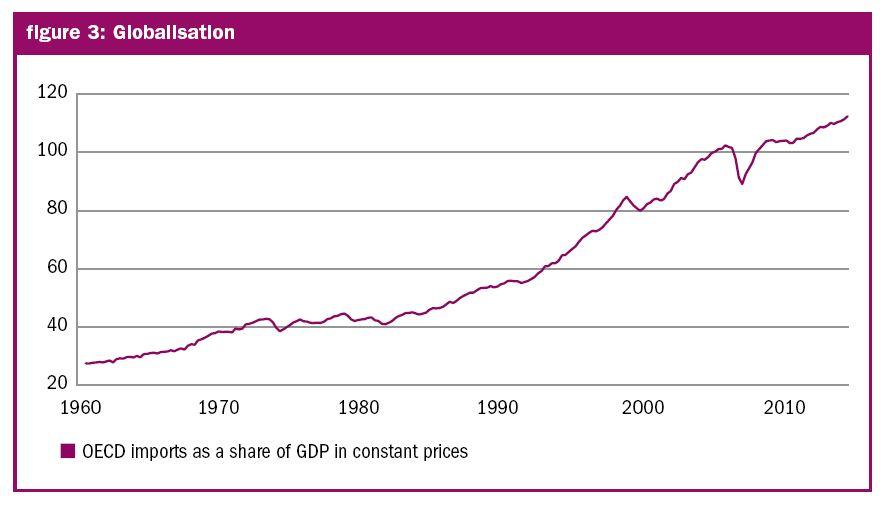

Globalisation, which stalled in the five years following the global financial crisis, is advancing again (figure 3). The pace has come down from the heydays of 1993-2008, but is comparable to earlier historical episodes. This is good news for EMs, many of which are integrated into the global production chain and rely on exports for development.

The picture of emerging markets’ manufacturing prowess, their motor of industrialisation, is more mixed. We observe a difference between incumbents like Korea, Mexico or Poland which are gaining market share, and latecomers like Brazil, South Africa or Philippines who are losing market share. If not reversed, this trend could hold back the latters’ convergence with advanced economies.

While new dawn is probably too strong, we believe that the outlook for emerging market growth has not been this good in a while. How do we express this view? The firmer growth outlook should support emerging market assets. With the equity outlook clouded by some of our risk scenarios and the potential impact of a strengthening US dollar on earnings, we prefer to express that currently in emerging market debt.

Peak coal?

Once the bedrock of the global energy system, coal’s position looks ever more threatened by the energy revolution. Our view is that the outlook for coal may actually be even worse than the already dire predictions of some forecasters. We think coal will be displaced from the current energy mix at an accelerating pace. More worryingly for coal investors, we estimate that the independently-traded coal market, also known as the seaborne market, is going to be disproportionately affected as key consumers increase their self-sufficiency.

Coal may be cheap to burn but the consequences are costly. Not only does coal contribute more than oil and gas to climate change through CO2 emissions, it also creates substantial air quality and pollution issues. No country has had to deal more with these problems than China. Any frequent visitor to China cannot help but notice how poor the air quality has become. If you travel into the industrial north or the developing west, it can be very unpleasant. In January 2017, the Chinese Ministry of Environmental Protection published data conceding that over 60 per cent of Chinese cities were suffering from significant air pollution issues. This problem might once have been ignored, but no longer: in late March, Beijing closed its last coal plant situated within city limits following constant public pressure.

Coal mining and trading is a substantial economic activity, accounting for $81bn of revenue in 2016 according to PWC. Our forecast of a long-term structural shift away from coal could have dramatic implications for investors.

Over the next 10–20 years, we believe that the largest coal consumer, China, will increase its self-sufficiency. At best, coal will form an ever decreasing share in a growing energy mix and has probably seen peak demand. Companies engaged in the business of mining coal to sell into the seaborne market are at risk of having substantial stranded reserves that will never be economically mined. Investors should therefore carefully consider their investments in companies that extract, ship and trade thermal coal.

For coal companies this is a miserable prediction, not just for their shareholders, but also their workforces and local communities who will require much in the way of transition assistance. However, coal is one of the most polluting and carbon-intensive fuel sources. If we are right, then this is tremendously positive for global climate change objectives, alongside encouraging implications for pollution and air quality.

Nancy Kilpatrick is head of unit trust relationships at Legal & General

Charity Finance wishes to thank Legal & General for its support with this article