Inflation has been a silent thief in recent years. Consumer prices rose 5.4% in 2021, 10.5% in 2022 and 4.0% in 2023. The Bank of England expects that consumer prices will rise another 2.75% over 2024. Charities’ costs have risen with inflation, but incomes are only growing around 1% per year. As a result, ever more charities are calling on their reserves.

Charities often keep those reserves “safe” with their banks. But inflation has eroded the purchasing power of £100 placed in the average current account at the start of 2021 to just £86 by the start of 2024. Many savings accounts have scarcely performed better.

So what’s the most prudent way now for charities to safeguard their reserves?

Large charities (with an income over £500,000) collectively hold around £31bn in cash, with more than half holding no long-term investments. As a result, they could miss out on around £1.5bn of income per year.

Bonds, stocks and other investments can be good long-term stores of value. But they aren’t always suitable if your charity wants ready access to its reserves.

Near-instant access

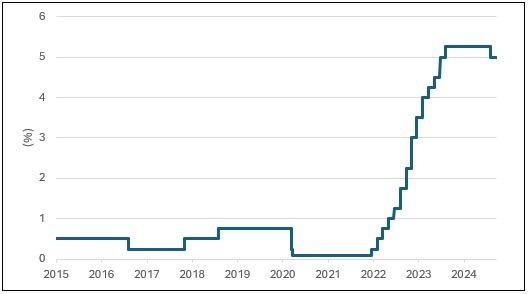

By contrast, so-called cash deposit funds (a) aim to offer returns close to the Bank of England’s Official Bank Rate with (b) a high degree of security and (c) near-instant access.

(a) Cash deposit funds aim to provide returns close to the Bank of England’s main interest rate. To achieve that goal, they constantly scour the market, and place your money with a range of banks and building societies, at the best interest rates they can find.

(b) A high degree of security: Cash deposit funds invest with banks and building societies that they’ve assessed as financially stable, some of which might not accept charities as account holders.

(c) Near-instant access: You can usually withdraw your cash from a cash deposit fund in two working days.

The Bank of England expects that consumer prices will rise another 2.75% over 2024. But most UK cash deposit funds now offer returns of around 5%, although this will fall if the Bank reduces interest rates. This premium allows you to recover some of the inflationary losses you’ve suffered in recent years. Don’t settle for less.