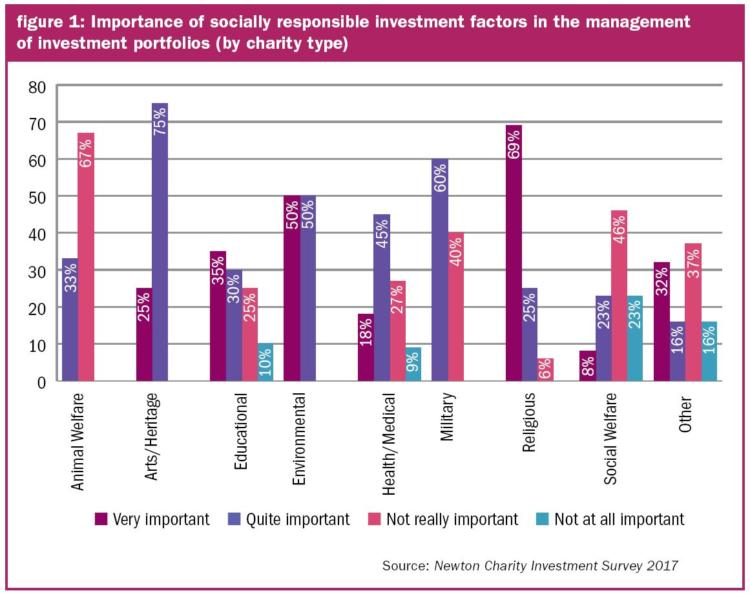

For some time now, socially responsible investing has been a key area of focus for many charities looking to ensure that their investments are aligned with the core aims of their mission. While the results vary significantly by charity type, the majority (62 per cent) of the 93 charities that were surveyed for Newton’s 2017 Charity Investment Survey rated social responsible investment factors as very or quite important in the management of their investment portfolios.

Traditionally, charities have often chosen to follow an ethical investment approach, which involves applying screens to avoid entire sectors. This could include, for example, sectors such as alcohol, armaments or adult entertainment, which would normally be excluded on moral or religious grounds.

Recently, as the topic of climate change – and the considerable risks that it presents to humanity – have risen up the agenda, it is unsurprising that many charities have been considering whether to adopt some form of fossil-fuel exclusion. The growing interest in this area is illustrated by our 2017 survey, in which 17 per cent of the charities surveyed had introduced a fossil-fuel exclusion policy, compared to only 4 per cent in 2015. Fossil-fuel exclusions potentially cover a far broader range of companies than other areas for which exclusions are currently applied, and the options for divestment are therefore more complex and varied.

While limiting the investment universe is likely to satisfy some charities’ ethical concerns, there is evidence that such an approach may hinder capital growth opportunities. Work commissioned by Newton and carried out by Warwick Business School has revealed that, over time, adopting an ethical stance has in general reduced investment returns, albeit perhaps less than one might expect. The research indicates that by adopting so-called sin screens to preclude investments in tobacco, alcohol, weapons, adult entertainment and gambling, developed-market equity returns were reduced by 0.47 per cent over the sample period of returns between 2004 and 2015.

Against this backdrop, in the last few years there has been growing interest in sustainable investing. Rather than avoiding stocks in certain sectors, this approach to responsible investing uses environmental, social and governance (ESG) analysis in order to positively identify companies with robust business models which effectively incorporate sustainability into their core business and strategy. A recent report from Morgan Stanley’s Institute for Sustainable Investing highlights how sustainable assets under management grew by 33 per cent between 2014 and 2016 to $8.72tn.

There is evidence that such a focus is being driven by the younger generation, for whom environmental and sustainability issues are increasingly important factors when determining which companies to buy from. Furthermore, according to a recent Schroders study of 20,000 end-investors in 28 countries, millennials ranked ESG factors as equally important as investment outcomes when considering investment decisions.

It can be argued that all investors should be interested in ESG because companies with effective ESG policies tend to be more transparent, and are therefore better understood by investors as well as their employees and customers. We believe ESG investing is a more effective way to invest responsibly, as it offers more say in how companies are run, as opposed to simply excluding all companies in certain sectors, as is the case with ethical investing.

Responsible investing has become particularly important over the last 15 years, as we have progressively focused on fully integrating ESG into the core investment process. We believe that all three elements of ESG can potentially add value for investors.

Breaking out the E, S and G

If you are an active investor, it is likely that you will be attracted to companies with a high quality of accounting, and the same can be said about ESG. The strength of a company’s ESG credentials can be crucial to making an accurate assessment of the potential risks, as well as the potential rewards. Some examples of factors to take into account when looking at a company include:

- Environmental: If a company is causing material harm to the environment as a heavy polluter, not only is that obviously bad for the environment, but it also means it runs the risk of government fines for its actions, which will have a negative impact on its bottom line.

- Social: A company that has a sector-high number of fatalities in the workplace would be a red flag, and would be a sign that the company might have some serious structural issues that need addressing.

- Governance: How a company’s management conducts itself is crucial to potential investors because it gets to the heart of how a company operates. It would include remuneration, board structure and alignment of interests to name a few. It is important that companies have a rigorous management structure because it adds transparency to the business model and can encourage better allocation of capital.

More than a box-ticking exercise

ESG should never be viewed simply as a box-ticking exercise. As investment managers we have ownership of investors’ assets, and responsibility to ensure that company management is held to account. We therefore actively engage in every vote in the companies we own, and also try to engage with companies prior to votes, to work out what they are doing and, in some cases, how we would like them to improve.

We are interested in engaging with companies across a broad range of topics, including remuneration and board structure, and seek to encourage companies to provide better disclosure on environmental factors. Having that disclosure in place helps them to focus on delivering on social and environmental goals, which is helpful for them and their investors. If we are dissatisfied with how companies are delivering, we will press them on their commitments.

An ESG-related investment approach can apply to both equity and fixed-income assets. A company’s management of its material ESG risks may affect its ability to repay its debt and fulfil its obligation to pay investors the coupon and principal to which they are entitled. We also consider ESG factors when evaluating risks in sovereign debt in the belief that those countries that govern effectively their natural, human, social and political capital are likely to experience greater stability in long-term growth and show more economic resilience.

Why charities should consider an ESG investing approach

Many fiduciaries have historically been reluctant to invest in strategies that have adopted ESG criteria, on the view that returns will be less than those from mainstream strategies. However, thinking seriously about ESG factors helps companies to build in discipline and can lead to better capital allocation. Indeed, companies that operate in a sustainable manner and optimise their resources will ultimately benefit shareholders. This is borne out by a broad range of research. Since the 1970s, over 2,000 academic studies have been published examining the link between ESG factors and financial performance. The vast majority of these studies have shown that integrating ESG analysis into the investment process has led to better corporate financial performance over the long term.

A truly active, integrated approach ties into the increased demand investors have when looking for responsible investments, and enables the manager to pursue a socially responsible agenda without compromising returns. For example, sustainable strategies which invest for the long term in well-run businesses that have both durable financial and competitive positions, and manage positively the material impacts of their operations and products on the environment and society, could help charities achieve their long-term investment goals in a responsible and sustainable manner.

Rob Stewart is head of responsible and charity investment at Newton

Charity Finance wishes to thank Newton for its support with this article