When charities talk about investment risk, they often label themselves as ‘moderate’ or ‘medium’ risk, reflecting the balance they need to strike between needing to produce capital growth and income, with that of prudence and not exposing their funds to undue risk.

In research published by Brewin Dolphin in late 2019 (and previously revealed on civilsociety.co.uk), the views of over 100 charities revealed a more detailed understanding of the different types of risk. Overall, when asked about their investment concerns, 36 per cent of charities cited risk as a main concern, up from 27 per cent two years ago.

It is important when talking about investment risk to consider the specific types of risks, in order to understand the overall risk profile for the organisation and to be clear in the Investment Policy Statement how risk is to be accommodated and managed.

This debate comes at an interesting time when markets have been strong (overall) for some time and many charities are wondering when the tide will turn; specific economic and geopolitical risks are present and markets have been volatile. It is also some years since some first-time investing charities took the decision to invest in markets, as they were no longer able to withstand the erosion of their purchasing power caused by sustainably low interest rates.

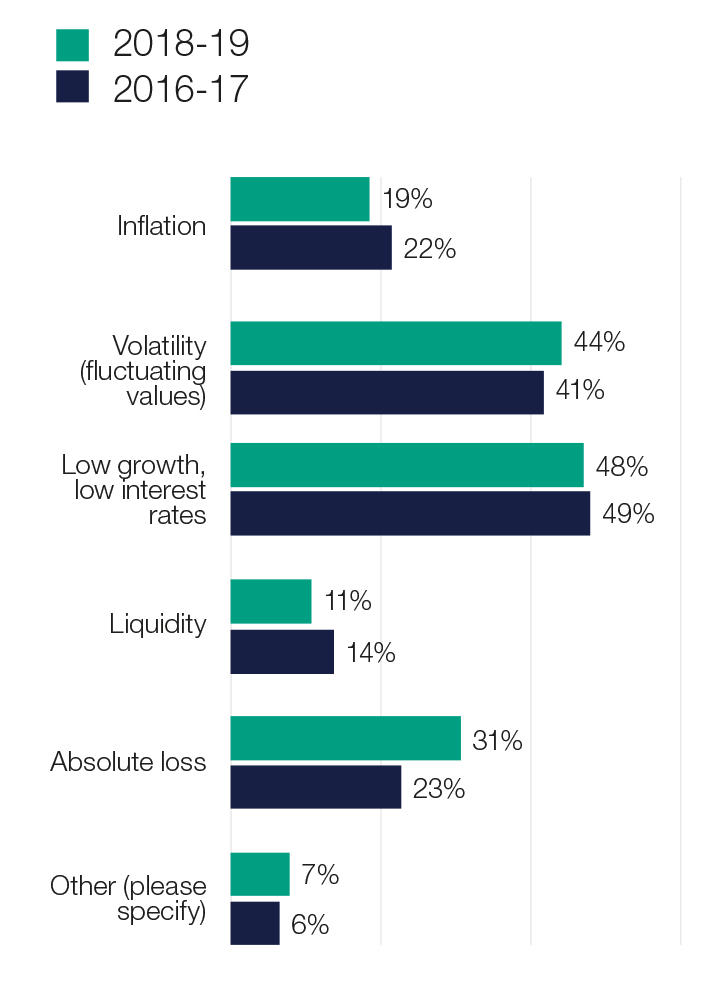

The chart below shows the biggest investment risk concerns from the research and compares it to the results in 2017:

Investors were most concerned about low growth/low interest rates and volatility, cited by 48 per cent and 44 per cent of respondents respectively. Low growth is always an interesting topic when asked to estimate future returns investors might expect. We continue to estimate single digit returns going forward; this may be in contrast to recent strong performance but it is important to remember that future returns are based on long-term averages that will include both markets rallies and market dips. Low growth/low interest rates are almost matched by the level of concern about volatility. Markets will continue to be volatile and it is important that investors are able to take a long-term view in order to ride out the peaks and the troughs. Whilst these topics were also the headline concerns in 2017, there was also a worrying increase in the proportion concerned with absolute loss, up from 1 in 4 (23 per cent in 2017) to 1 in 3 (31 per cent ) two years on.

Looking at the risk concerns between service providing charities and grantmakers, the fixed costs of service providers, understandably, gives them greater concerns about liquidity. The number of service providers concerned about liquidity was eightfold that of grantmakers. A fear further supported by another finding - that nearly 50 per cent of charities were not confident about their future funding levels, highlights the vital need for access to other funds to ensure the smooth operations of the organisation.

Whichever risks cause most concern to any one charity investor, achieving the right balance between spending and capital preservation is easier if they keep the investments under review in the context of the wider spending plans. What the invested assets are designed to achieve and which risks can be tolerated should be a regular conversation, both around the charity meeting table and with their investment managers.

You can download a full copy of the report here.

Ruth Murphy is head of charities at wealth manager Brewin Dolphin

This content has been supplied by a commercial partner.

The value of investments and any income from them can fall and you may get back less than you invested.

The information contained in this article is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

The opinions expressed in this publication are not necessarily the views held throughout Brewin Dolphin Ltd.

Related articles