Socially responsible investing has long been a key area of focus for many charities looking to ensure that their investments are aligned with the core aims of their mission. Traditionally, charities have often chosen to follow an ethical investment approach, which involves applying screens to avoid entire sectors (such as tobacco or fossil fuels). More recently, there has been a lot of talk about the new concept of sustainable investing, particularly as the topic of climate change – and the considerable risks that it presents to humanity – has risen up the agenda.

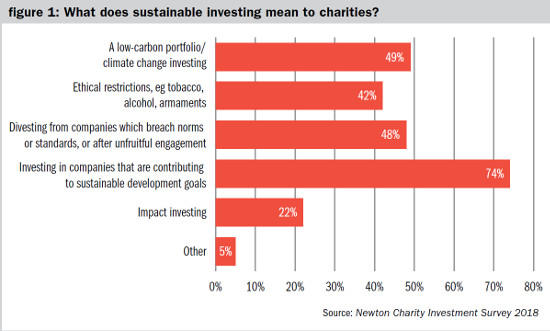

However, the precise meaning of the term sustainable investing is still open to interpretation. In Newton’s 2018 Charity Investment Survey, 97 UK charities were asked what sustainable investment meant to them and provided a wide range of answers. The most popular was investing in companies contributing to sustainable development goals. Other recurring responses included having a low-carbon portfolio, climate-change investing, having ethical restrictions, and divesting from companies that breach norms and standards or do not respond well to engagement. A smaller number of respondents considered sustainable investing to be the same as impact investing.

To Newton, sustainable investing is about putting environmental, social and governance (ESG) considerations at the core of the investment process. Investors across the world are becoming more interested in the integration of ESG issues in their portfolios, with over $22tn of assets now managed under responsible investment strategies globally, an increase of 25 per cent since 2014, according to the Global Sustainable Investment Review.

One reason for this growth is the mounting conviction that a sustainable approach does not require investors to sacrifice financial returns, and could even enhance returns over the long term. Recent research by Harvard Business School, for example, has found that firms making investments and improving their performance on ESG issues exhibit better future stock-market performance and profitability.

Looking at ESG factors can help investors pinpoint risks beyond those identified in a company’s financial statements – risks which can have a material impact on a company’s performance and reputation.

Not every company that is well aligned in terms of sustainability will succeed, so careful analysis and discerning discrimination between competing business models and management teams will be essential to generate the long-term financial rewards available. Judicious engagement with certain companies is another avenue that could help to influence those companies positively.

Engagement – seeking to catalyse change

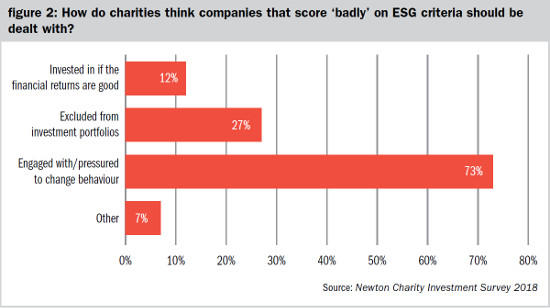

In the 2018 survey, 71 per cent of the charities surveyed stated that ESG factors were important to them when considering the management of their investment portfolios. We also asked charities about the effectiveness of engagement with companies on ESG issues. This, after all, is one of the principal reasons to incorporate ESG analysis into an investment approach. The vast majority of charities felt there was at least some impact on company behaviours resulting from ESG engagement, with 9 per cent believing that these changes in behaviour were positive. In addition, almost three-quarters of charities thought that the best approach to dealing with companies that score badly on ESG criteria was to engage with a company to change its behaviour, a response that was almost three times more popular than to exclude the company from an investment portfolio.

Conversely, over half the charities surveyed felt the impact of ESG engagement on investment performance was likely to be negative, implying that while charities believe it is important to engage to change company behaviours, they feel this may come at some investment cost. This is perhaps surprising, since the positive effect of active engagement is supported by academic research. A 2015 study by the Centre for Endowment Asset Management looked at the success of engagements from a single asset manager with 613 public US companies over a ten-year period. The paper concluded that successful engagements led to meaningfully improved financial and share-price performance, alongside better governance. The study also found that collaboration between investors, particularly in relation to environmental and social issues, contributed positively to the success of engagements. This research has been followed up by a more global study in which the preliminary results indicate similar trends.

It is our belief that engagement with companies that demonstrate the potential to improve their performance on ESG issues can enable both shareholders and society to capture real benefits. For example, one could engage with a utility company to encourage it to shift from coal power to wind generation. The most direct form of engagement is taking an equity stake and voting. However, we also believe that using human interaction to maintain a meaningful dialogue with a company is vital in helping to deliver better outcomes for shareholders, companies and society as a whole. We have seen a number of areas where we have been able to help drive corporate change, from better disclosure to pushing for corporate reform and engaging actively on the details of many corporate incentive packages. Together with other asset management firms, we have also led a group of investors encouraging the oil and gas industry to take greater responsibility for its emissions and to improve the transparency of reporting in this area.

An active approach to ESG

We think that such engagement activity should form a key part of any sustainable investment strategy. Another important feature, in our view, is the use of red lines in order to rule out certain companies from being considered for investment, such as those which violate the UN Global Compact’s ten principles that promote responsible corporate citizenship (relating to areas such as corruption, labour standards, human rights and the environment). We also believe that companies with characteristics which make them incompatible with the aim of limiting global warming to 2°C have no place in sustainable portfolios.

In this context, a truly active, integrated approach to considering ESG issues can help to positively identify companies with robust business models which effectively incorporate sustainability into their core business and strategy. It can also seek out and support those companies that are making the positive transition to more sustainable activities. Such an investment approach could help charities achieve their long-term investment goals in a responsible and sustainable manner.

Rob Stewart is head of responsible and charity investment at Newton

Charity Finance wishes to thank Newton for its support with this article